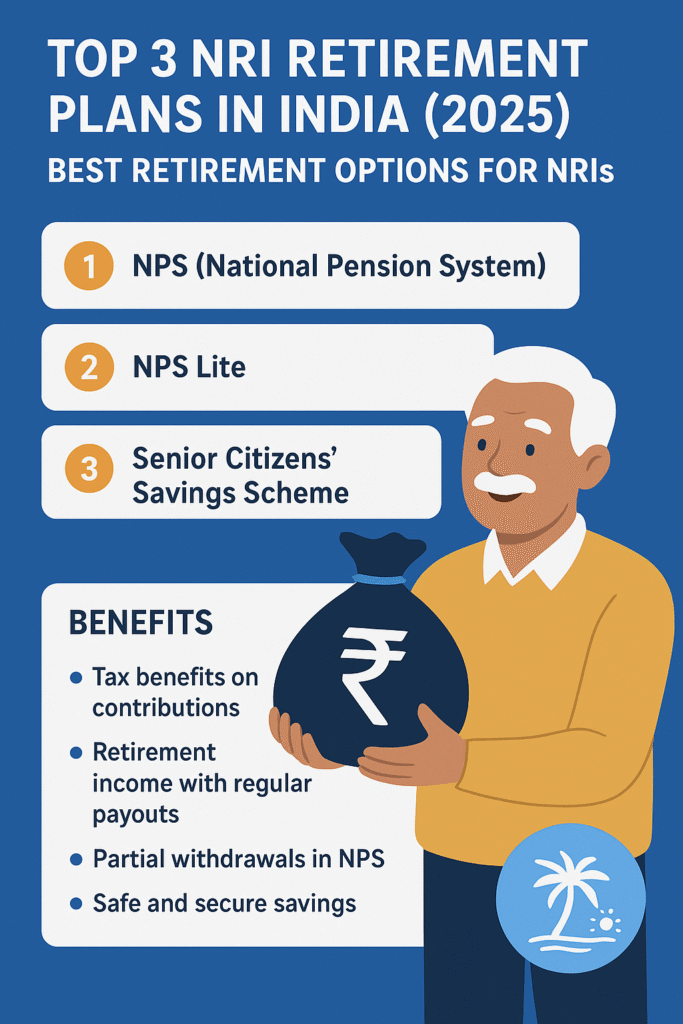

If you’re an NRI, retirement planning hits differently, doesn’t it?. Here we are discussing Top 3 NRI Retirement Plans in India

One foot abroad, the other firmly planted in India. Maybe your heart is still in Kerala, Chennai, or Mumbai. Maybe your parents are there, your home is there, or that quiet retirement dream by the beach or hometown temple hasn’t left your mind.

That’s exactly why choosing the right NRI retirement plan in India matters so much.

In this detailed guide, I’ll walk you through the Top 3 NRI Retirement Plans in India (2026) and explain why these are considered the best retirement options for NRIs today. No jargon overload. No salesy nonsense. Just practical insights from an NRI-to-NRI perspective.

We’ll talk about:

- Safety vs returns

- Tax efficiency for NRIs

- Regular income after retirement

- And how these plans actually work in real life

Let’s dive in.

Table of Contents

- Why NRIs Need India-Focused Retirement Planning

- What Makes a Good NRI Retirement Plan?

- Top 3 NRI Retirement Plans in India (2026)

- National Pension System (NPS)

- Mutual Fund Retirement Solutions

- Senior Citizen–Oriented Guaranteed Income Plans

- Comparison Table: Best Retirement Options for NRIs

- How to Choose the Right Plan as an NRI

- Common Mistakes NRIs Make in Retirement Planning

- FAQs: NRI Retirement Plans in India

- Final Thoughts: Building Your India Retirement Roadmap

Why NRIs Need India-Focused Retirement Planning

When we talk about the top 3 NRI retirement plans in India, the discussion always starts with one simple reality: NRIs need retirement planning that is rooted in India. The best retirement options for NRIs are those that recognise where life after 60 is likely to unfold — in Indian cities, towns, and communities.

Here’s a truth many NRIs realise a little late:

Earning abroad is global, but retirement is deeply local.

Healthcare, family support, cost of living, property, and emotional comfort — all point towards India for many NRIs. That’s why NRI retirement plans in India aren’t optional; they’re essential.

The best retirement options for NRIs should ideally:

- Generate income in INR

- Protect against currency risk

- Offer tax efficiency under Indian laws

- Be simple to manage from abroad

And yes, 2026 brings new clarity on regulations, making now a good time to plan.

What Makes a Good NRI Retirement Plan?

Before choosing from the top 3 NRI retirement plans in India, every NRI should understand what truly separates average products from the best retirement options for NRIs.

Before jumping into the top 3 NRI retirement plans in India, let’s get clear on what actually matters.

Key Criteria NRIs Should Look For

- Regulatory clarity (RBI, SEBI, PFRDA compliant)

- Long-term stability

- Inflation-beating potential

- Easy repatriation or local usage

- Tax treatment for NRIs

If a plan doesn’t tick most of these boxes, it’s probably not among the best retirement options for NRIs, no matter how attractive it looks.

Top 3 NRI Retirement Plans in India (2026)

This section focuses exclusively on the top 3 NRI retirement plans in India, widely regarded by experts as the best retirement options for NRIs in 2026 due to their balance of safety, growth, and income generation.

Now let’s get to the core.

These are the top 3 NRI retirement plans in India based on safety, returns, flexibility, and real-world usability.

1. National Pension System (NPS) – The Backbone of NRI Retirement Planning

Among the top 3 NRI retirement plans in India, NPS consistently ranks high and is often described as one of the best retirement options for NRIs seeking long-term structure.

If there’s one government-backed option that genuinely deserves attention, it’s NPS.

Why NPS Is One of the Best Retirement Options for NRIs

NPS is a long-term, disciplined retirement system regulated by PFRDA. For NRIs, it offers a rare mix of low cost, market-linked growth, and structured withdrawals.

Key Features

- Available for NRIs aged 18–70

- Invests in equity, corporate bonds, and government securities

- Extremely low fund management charges

- Partial equity exposure even close to retirement

This makes NPS a strong contender among NRI retirement plans in India.

NPS Tax Benefits for NRIs

While NRIs don’t get all resident benefits, NPS still offers:

- Tax-deferred growth

- Favorable taxation on maturity

- Partial tax-free lump sum on exit

For many NRIs, this alone makes NPS one of the best retirement options for NRIs in 2026.

Real-Life Example

An NRI in Kuwait investing ₹50,000 per month into NPS from age 40 can potentially build a solid pension corpus by 60, with part of it converting into guaranteed annuity income.

READ: HOW CAN NRI TRADE IN THE INDIAN SHARE MARKET

2. Mutual Fund Retirement Solutions – Flexibility Meets Growth

When NRIs look beyond NPS, mutual funds clearly stand out among the top 3 NRI retirement plans in India and are frequently counted as the best retirement options for NRIs who want flexibility.

If NPS is discipline, mutual funds are freedom.

Why Mutual Funds Are Among the Top 3 NRI Retirement Plans in India

Mutual funds give NRIs unmatched flexibility. You control:

- Asset allocation

- SIP amounts

- Withdrawal timing

This makes them one of the best retirement options for NRIs who want growth plus liquidity.

Best Mutual Fund Categories for NRI Retirement

- Hybrid Aggressive Funds

- Equity Index Funds

- Balanced Advantage Funds

- Retirement-oriented solution funds

Used correctly, these form a powerful NRI retirement strategy.

Taxation Snapshot

- LTCG taxed at 10–20% depending on fund type

- TDS applicable for NRIs

- Repatriation allowed subject to FEMA rules

Despite taxes, mutual funds remain core to NRI retirement plans in India.

Relatable Moment

Most NRIs I speak to start SIPs with big enthusiasm… and then forget them. Ten years later, they’re shocked (in a good way) by the corpus.

That’s the magic of disciplined investing.

3. Guaranteed Income & Senior-Focused Plans – Stability After 60

Guaranteed income products complete the list of the top 3 NRI retirement plans in India, especially for those who prefer certainty over volatility. These remain some of the best retirement options for NRIs post-retirement.

Let’s be honest.

Not everyone wants market-linked returns after retirement.

That’s why guaranteed-income options still rank among the top 3 NRI retirement plans in India.

Common Options

- Pradhan Mantri Vaya Vandana Yojana (where applicable)

- Insurance-based annuity plans

- RBI-regulated fixed-income instruments

These plans shine when stability matters more than growth.

Why They’re Still the Best Retirement Options for NRIs (Post-Retirement)

- Predictable monthly income

- Lower volatility

- Peace of mind for spouses and dependents

They’re not flashy, but they work.

Comparison Table: Top 3 NRI Retirement Plans in India

| Feature | NPS | Mutual Funds | Guaranteed Income Plans |

| Risk Level | Medium | Medium–High | Low |

| Returns Potential | Moderate | High | Low–Moderate |

| Liquidity | Limited | High | Limited |

| Ideal Age | 30–55 | 25–60 | 55+ |

| NRI-Friendly | Yes | Yes | Selective |

All three together form the best retirement options for NRIs when combined smartly.

How to Choose the Right Plan as an NRI

Ask yourself:

- Where will I retire — India or abroad?

- Do I need monthly income or lump sum?

- Can I handle market ups and downs?

A balanced approach using all top 3 NRI retirement plans in India usually works best.

Common Mistakes NRIs Make in Retirement Planning

- Relying only on NRE FDs

- Ignoring inflation in India

- Starting too late

- No INR-based income planning

Avoid these, and you’re already ahead of most people.

FAQs: NRI Retirement Plans in India

Are NRIs allowed to invest in retirement plans in India?

Yes. Many NRI retirement plans in India are fully legal and regulated by RBI, SEBI, and PFRDA. These include NPS, mutual funds, and select guaranteed income plans, making them some of the best retirement options for NRIs.

Which is the safest retirement plan for NRIs?

Among the top 3 NRI retirement plans in India, NPS and government-backed guaranteed income schemes are considered the safest retirement options for NRIs who prioritise capital protection.

Can NRIs get regular monthly income after retirement in India?

Yes. By combining NPS annuity income, mutual fund SWPs, and guaranteed income plans, NRIs can create stable monthly cash flow using the best retirement options for NRIs.

Can retirement income be repatriated abroad?

Some NRI retirement plans in India, such as mutual funds, allow repatriation subject to FEMA rules. Others are best used for local expenses in India.

Is 2026 a good time to start retirement planning for NRIs?

Absolutely. Starting early allows compounding to work in your favour, making today the right time to invest in the top 3 NRI retirement plans in India.

Final Thoughts: Your Retirement, Your Rules

By now, it should be clear that the top 3 NRI retirement plans in India work best when used together, not in isolation. For most people, combining these creates the best retirement options for NRIs who want growth before retirement and stability after retirement.

Retirement isn’t just about money.

It’s about dignity, comfort, and freedom.

By choosing the top 3 NRI retirement plans in India, and combining them wisely, you can build a future that feels secure — whether you’re in Dubai today or dreaming of mornings back home tomorrow.

If you’re serious about long-term peace of mind, these truly are the best retirement options for NRIs in 2026.

Start small. Stay consistent. And let time do the heavy lifting.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. NRIs should consult a SEBI-registered advisor before investing.

Pingback: NPS for NRIs EXPLAINED | Secure Your Retirement Anywhere -

Pingback: Looking for the best demat account for NRIs in 2025? This in-depth guide explains PIS vs Non-PIS accounts,banks, brokers,and how NRIs can invest smartly in India.