Confused about PIS vs non-PIS account? This detailed guide explains NRI trading account types, rules, examples, pros & cons, and helps NRIs choose the right option.

If you’re an NRI thinking about investing in Indian shares, one question always pops up sooner or later:

“Should I open a PIS or non-PIS account?”

Honestly, the confusion around PIS vs non-PIS account is very real. I’ve seen NRIs in the Gulf, US, UK, and even Singapore delay investing for years simply because they didn’t understand NRI trading account types clearly.

So let’s fix that today.

In this detailed guide, I’ll explain PIS vs non-PIS account in simple language—no legal jargon, no banker-style explanations. Just real-world clarity, examples, and practical advice, written from one NRI to another.

By the end of this article, you’ll know:

- What PIS and non-PIS accounts really mean

- Which NRI trading account types suit your goals

- Common mistakes NRIs make (and how to avoid them)

Let’s dive in.

Table of Contents

- Why NRIs Get Confused About PIS vs Non-PIS Account

- What Is a PIS Account? (Simple Explanation)

- What Is a Non-PIS Account?

- PIS vs Non-PIS Account – Core Difference

- NRI Trading Account Types Explained

- Who Should Choose a PIS Account?

- Who Should Choose a Non-PIS Account?

- PIS vs Non-PIS Account – Comparison Table

- Real-Life NRI Examples

- Common Myths About PIS and Non-PIS

- Charges and Cost Comparison

- Taxation Impact on NRI Trading Account Types

- Can NRIs Have Both PIS and Non-PIS Accounts?

- Mistakes NRIs Must Avoid

- FAQs on PIS vs Non-PIS Account

- Final Thoughts – Choosing the Right Account

1. Why NRIs Get Confused About PIS vs Non-PIS Account

Let’s be honest.

When banks explain PIS vs non-PIS account, they often use technical terms like FEMA, RBI reporting, and designated branches. For an NRI who just wants to buy a few Indian stocks, that’s overwhelming.

Plus, different brokers give different advice, which adds to the confusion about NRI trading account types.

So instead of memorising definitions, let’s understand the purpose behind these accounts.

2. What Is a PIS Account? (Simple Explanation)

PIS stands for Portfolio Investment Scheme.

In simple terms, a PIS account is used when an NRI wants to buy and sell Indian shares on a repatriable basis, under the supervision of the RBI.

Here’s the easiest way to understand it:

A PIS account allows NRIs to trade Indian stocks while RBI keeps track of every transaction.

This RBI reporting is the key reason PIS vs non-PIS account exists in the first place.

Key features of a PIS account:

- Linked to NRE account (mostly)

- Transactions are reported to RBI

- Used for equity delivery trading

- Mandatory for repatriable investments

So whenever someone asks about NRI trading account types, PIS is usually the first category mentioned.

3. What Is a Non-PIS Account?

Now let’s talk about the other side of the PIS vs non-PIS account debate.

A non-PIS account is used when an NRI invests without RBI’s PIS reporting.

This usually applies to:

- Investments from NRO account

- Non-repatriable investments

- Certain market segments like mutual funds or F&O

In simpler words:

A non-PIS account is more flexible but comes with repatriation limits.

When discussing NRI trading account types, non-PIS accounts often surprise NRIs because they’re actually very useful.

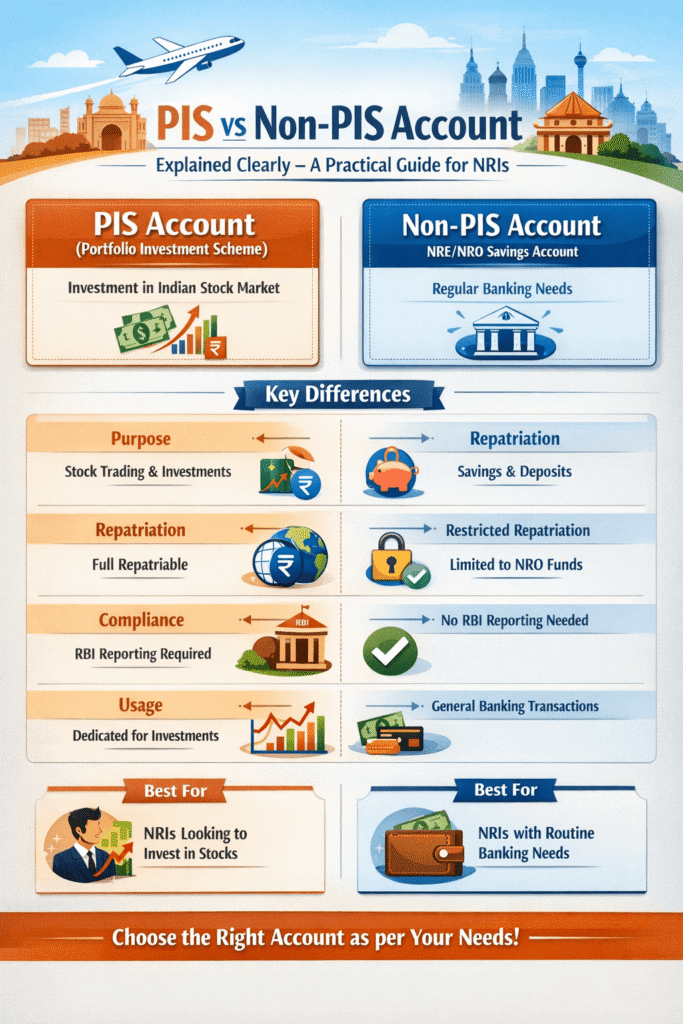

4. PIS vs Non-PIS Account – The Core Difference

Let’s pause and simplify this.

The real difference in PIS vs non-PIS account comes down to RBI reporting and repatriation.

- PIS account → RBI tracks trades, repatriation allowed

- Non-PIS account → No RBI PIS tracking, limited repatriation

That’s it.

Everything else—charges, complexity, suitability—flows from this core difference.

5. NRI Trading Account Types Explained

To understand NRI trading account types, think in categories instead of labels.

Common NRI trading account types:

- PIS trading + demat account

- Non-PIS trading + demat account

- F&O trading account (non-PIS)

- Mutual fund investment account

So when you hear brokers talk about NRI trading account types, they’re usually referring to combinations of these.

6. Who Should Choose a PIS Account?

You should seriously consider a PIS account if:

- You want to repatriate sale proceeds abroad

- You invest mainly in delivery-based equity

- You prefer RBI-compliant structured investing

- You’re building long-term wealth in India

For many long-term investors, PIS vs non-PIS account isn’t even a debate—PIS becomes the default choice.

7. Who Should Choose a Non-PIS Account?

On the other hand, a non-PIS account is ideal if:

- You invest using NRO funds

- You don’t need immediate repatriation

- You want lower compliance

- You trade in F&O or mutual funds

This is why understanding NRI trading account types properly can save you money and stress.

8. PIS vs Non-PIS Account – Comparison Table

| Feature | PIS Account | Non-PIS Account |

|---|---|---|

| RBI Reporting | Yes | No |

| Repatriation | Allowed | Limited |

| Linked Account | NRE | NRO |

| Compliance | High | Lower |

| Ideal For | Long-term equity | Flexibility |

This table alone clears up 80% of PIS vs non-PIS account confusion.

9. Real-Life NRI Examples

Example 1: Gulf NRI (PIS Account)

Ahmed works in Kuwait and sends money to India for investments. He wants the option to bring money back later.

For him, PIS vs non-PIS account is simple—PIS fits his needs.

Example 2: US NRI (Non-PIS Account)

Rohit uses rental income in India to trade occasionally. He doesn’t need repatriation.

A non-PIS account suits his NRI trading account type perfectly.

10. Common Myths About PIS vs Non-PIS Account

Let’s bust a few myths.

❌ “PIS is mandatory for all NRIs”

✅ False. It depends on investment type.

❌ “Non-PIS is illegal”

✅ Absolutely false. It’s FEMA-compliant.

Understanding myths helps clarify PIS vs non-PIS account decisions.

11. Charges and Cost Comparison

Here’s something brokers don’t highlight enough.

PIS accounts usually involve:

- Higher bank charges

- Designated branch fees

- Annual PIS maintenance cost

Non-PIS accounts:

- Lower charges

- Simpler structure

So when evaluating NRI trading account types, cost matters.

12. Taxation Impact on NRI Trading Account Types

Taxation doesn’t change much between PIS vs non-PIS account, but:

- TDS applies on capital gains

- DTAA benefits may apply

- Compliance is easier with proper reporting

Always remember: tax planning is as important as choosing NRI trading account types.

13. Can NRIs Have Both PIS and Non-PIS Accounts?

Yes, NRIs can have both.

In fact, many experienced investors do exactly that:

- PIS for long-term equity

- Non-PIS for flexibility and trading

This hybrid approach often works best when navigating PIS vs non-PIS account decisions.

14. Mistakes NRIs Must Avoid

Here are common mistakes I’ve seen:

- Opening wrong account type

- Mixing NRE and NRO funds

- Ignoring repatriation rules

- Choosing broker without NRI expertise

Avoiding these mistakes makes NRI trading account types much easier to manage.

15. FAQs – PIS vs Non-PIS Account

Is PIS compulsory for NRIs?

No. It depends on how and from where you invest.

Can I trade F&O with a PIS account?

No. F&O requires a non-PIS account.

Which is better: PIS vs non-PIS account?

There’s no “better”—only what fits your goal.

16. Final Thoughts – Choosing the Right Account

At the end of the day, PIS vs non-PIS account isn’t about rules—it’s about clarity.

Once you understand NRI trading account types, the decision becomes surprisingly simple.

Start with your goal.

Understand your money flow.

Choose the account that matches your reality—not someone else’s advice.

If you’re unsure, take professional guidance. But don’t delay investing just because the terminology sounds complicated.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. NRIs should consult a SEBI-registered advisor or their bank before opening trading accounts.

Pingback: NRI Demat Documents: Complete KYC Checklist for 2026 - myfinteche.com

Pingback: Tax on NRI Share Trading in India | Capital Gains Explained

Pingback: Zerodha vs Fyers for NRI – Best Trading App for NRIs - myfinteche.com

Pingback: DTAA for NRI Trading: Your Tax Impact Explained - myfinteche.com