NRI demat documents explained clearly. Check the complete list of NRI demat KYC documents, bank proofs, PIS vs Non-PIS rules, and FAQs.

If you’re an NRI planning to invest in Indian shares, mutual funds, or ETFs, one question comes up almost immediately:

“What are the documents required for NRI demat account opening?”

Honestly, this step confuses many NRIs more than market volatility itself.

Between NRI demat KYC documents, bank paperwork, PIS vs Non-PIS confusion, and embassy attestation myths, things can feel overwhelming. But don’t worry — let’s simplify everything, step by step, just like an experienced NRI investor would explain it to a friend over chai ☕.

In this guide, we’ll break down documents required for NRI demat account opening in 2026, explain why each document is needed, and share real-world tips so your application doesn’t get rejected.

📑 Table of Contents

- What Is an NRI Demat Account?

- Why Documents Matter for NRIs

- Basic Documents Required for NRI Demat Account

- Identity Proof (Mandatory)

- Address Proof (Indian & Overseas)

- PAN Card Requirements for NRIs

- Passport & Visa Documents

- Bank Account Documents (NRE/NRO)

- PIS vs Non-PIS: Extra Documents Explained

- FATCA & CRS Declarations

- In-Person Verification (IPV)

- Attestation Rules Explained Simply

- Common Mistakes NRIs Make

- FAQs on NRI Demat KYC Documents

- Final Checklist Before Submission

1️⃣ NRI Demat Documents – Complete Overview

An NRI demat account allows Non-Resident Indians to hold and trade Indian securities while staying compliant with RBI and SEBI regulations.

To open one, brokers must verify your identity, residency, and banking trail. That’s why documents required for NRI demat account are more detailed than resident accounts.

And yes, NRI demat KYC documents are mandatory — no shortcuts here.

2️⃣ Why Documentation Is Critical for NRIs

Unlike resident investors, NRIs operate across borders. Regulators want clarity on:

- Your residency status

- Your source of funds

- Your tax jurisdiction

- Your banking channel (NRE or NRO)

That’s why brokers insist on strict NRI demat KYC documents, even if you already had a resident demat account earlier.

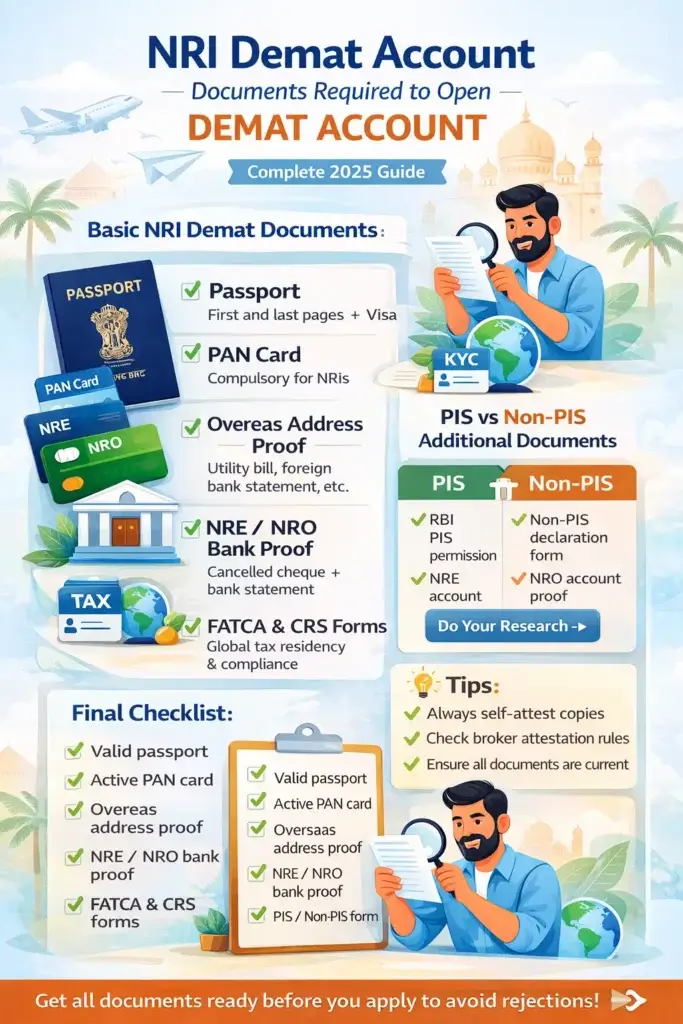

3️⃣ Mandatory NRI Demat Documents for Account Opening

Let’s start with a bird’s-eye view.

The documents required for NRI demat account fall into these categories:

- Identity proof

- Address proof (Overseas + Indian)

- PAN card

- Passport & visa

- Bank account proof

- PIS / Non-PIS declaration

- FATCA & CRS forms

Each of these NRI demat KYC documents serves a specific compliance purpose.

4️⃣ Identity Proof – Who You Are

Your identity proof confirms who you are as an investor.

Accepted Identity Proofs:

- Valid Passport (mandatory)

- PAN Card (Indian)

📌 Important:

For NRIs, passport is the primary identity document, not Aadhaar.

Among all documents required for NRI demat account, passport copy is non-negotiable.

5️⃣ Address Proof – Where You Live (Two Addresses!)

Here’s where NRIs often get confused.

You must submit two address proofs as part of NRI demat KYC documents:

A. Overseas Address Proof

Any one of the following:

- Utility bill (electricity / water / gas)

- Bank statement (foreign bank)

- Driving licence

- Residence permit

B. Indian Address Proof (Optional but Preferred)

- Aadhaar

- Indian bank statement

- Registered rent agreement

Yes, overseas proof is compulsory.

This is a core part of documents required for NRI demat account.

6️⃣ PAN Card – Tax Backbone of Your Investments

No PAN? No investing in India.

PAN is compulsory for:

- Capital gains tax

- Dividend taxation

- KYC validation

Your PAN must be active and linked to your demat account.

Among all NRI demat KYC documents, PAN is the single most critical tax document.

7️⃣ Passport & Visa – Residency Proof

Your passport does double duty:

- Identity proof

- Residency confirmation

Required Pages:

- First page (photo & details)

- Last page

- Visa page (work / residence visa)

Expired visa?

Your application may get rejected, even if other documents required for NRI demat account are perfect.

8️⃣ Bank Account Documents (NRE / NRO)

You cannot open an NRI demat account without an NRI bank account.

Required Documents:

- Cancelled cheque (NRE/NRO)

- Bank statement (last 6 months)

These are essential NRI demat KYC documents because funds must move through RBI-approved channels only.

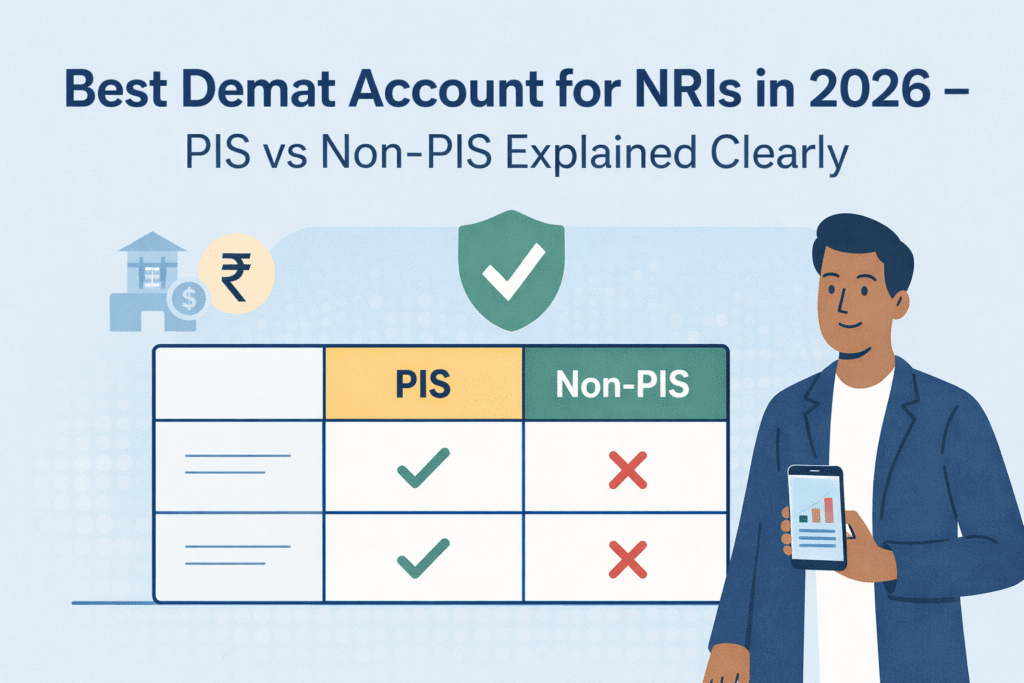

9️⃣ NRI Demat Documents for PIS vs Non-PIS Accounts

This is where many NRIs pause.

PIS Account – Extra Documents

- RBI-approved PIS permission letter

- Linked NRE bank account

- Separate trading account mapping

Non-PIS Account – Simpler

- Declaration for Non-PIS usage

- Linked NRO account

Depending on your choice, documents required for NRI demat account will slightly vary.

🔍 Quick Comparison

| Requirement | PIS | Non-PIS |

|---|---|---|

| RBI Approval | Yes | No |

| Account Complexity | High | Low |

| Typical Use | Equity delivery | MF, ETFs |

🔟 FATCA & CRS Declarations

Global compliance alert 🚨

Every NRI must submit:

- FATCA self-declaration

- CRS tax residency form

These forms confirm:

- Country of tax residence

- Foreign TIN (if applicable)

These are mandatory NRI demat KYC documents, even if you live in GCC countries like UAE, Kuwait, or Saudi Arabia.

1️⃣1️⃣ In-Person Verification (IPV)

Earlier, NRIs needed embassy visits. Not anymore.

Today, IPV can be done via:

- Video KYC

- Live webcam verification

- Recorded declaration

Still, IPV is part of documents required for NRI demat account completion.

1️⃣2️⃣ Attestation Rules – Simplified

Most brokers accept self-attested documents.

However, some may require attestation by:

- Indian embassy

- Notary public

- Banker

Always check this before submitting NRI demat KYC documents to avoid rework.

1️⃣3️⃣ Common Mistakes in NRI Demat Documents Submission

Even experienced investors slip up.

❌ Submitting expired visa

❌ Address mismatch across documents

❌ Using resident bank account

❌ Skipping FATCA form

Any one of these can delay approval of your documents required for NRI demat account.

1️⃣4️⃣ FAQs on NRI Demat Documents and KYC

❓ Is Aadhaar mandatory for NRIs?

No. Aadhaar is optional, not part of mandatory NRI demat KYC documents.

❓ Can I open demat without NRE/NRO account?

No. Bank proof is compulsory.

❓ Do I need separate documents for trading account?

Mostly no. Same documents required for NRI demat account apply.

❓ How long does verification take?

Typically 5–10 working days, depending on document clarity.

1️⃣5️⃣ Final Checklist – Before You Submit

✔ Passport (valid)

✔ PAN card

✔ Overseas address proof

✔ NRE / NRO bank proof

✔ Visa copy

✔ FATCA declaration

✔ PIS / Non-PIS declaration

If all documents required for NRI demat account are correct, approval is smooth.

🏁 Final Thoughts – From One NRI to Another

If you’re serious about investing in India, getting your NRI demat KYC documents right is step one. Yes, the process looks long, but once done, investing becomes seamless.

Think of it as a one-time effort for long-term wealth creation back home 🇮🇳.