How NRIs Can Open Demat Account from Abroad (Step-by-Step)

Learn how to open NRI demat account from abroad. Step-by-step online process, documents, KYC rules, notarisation clarity, and FAQs.

If you’re an NRI living abroad and planning to invest in Indian shares, mutual funds, or ETFs, one question always comes first:

“Can I open an NRI demat account from abroad without visiting India?”

The short answer is yes — and today, you can even do it fully online.

In fact, thousands of NRIs now open NRI demat account from abroad every year using digital KYC, courier-based verification, and online onboarding. Whether you’re in the Gulf, US, UK, Canada, Australia, or Europe, the process has become simpler than ever.

In this detailed guide, I’ll explain how NRIs can open demat account from abroad step-by-step, based on real broker processes, RBI rules, and common mistakes NRIs make. I’ll also clear up confusion around notarisation, passport attestation, and overseas address proof — something many blogs get wrong.

So let’s get started.

Table of Contents

- Why NRIs Need a Separate Demat Account

- Can NRIs Open Demat Account from Abroad?

- Types of NRI Demat Accounts

- PIS vs Non-PIS: Which One Do You Need?

- Step-by-Step: How to Open NRI Demat Account from Abroad

- Documents Required for NRI Demat Account Online

- Important KYC & Notarisation Clarification (Updated)

- Who Can Attest NRI Documents from Abroad

- How Long Does It Take to Open NRI Demat Account Online?

- Charges & Fees NRIs Should Know

- Common Mistakes NRIs Make

- Real-Life Example: NRI Opening Demat from Abroad

- FAQs

- Final Thoughts

1. Why NRIs Need a Separate Demat Account

If you’ve recently become an NRI, your resident demat account is no longer valid for fresh investments.

As per FEMA rules:

- NRIs cannot use resident demat or trading accounts

- All investments must be routed through NRI-specific accounts

That’s why the first legal step is to open NRI demat account from abroad or after your status changes.

2. Can NRIs Open Demat Account from Abroad?

Yes, absolutely.

Today, most banks and brokers allow you to open NRI demat account online without travelling to India. The process usually involves:

- Online application

- Digital KYC

- Document upload

- Courier (in some cases)

So even if you’re working night shifts in Dubai or finishing meetings in Toronto, you can still open NRI demat account from abroad comfortably.

3. Types of NRI Demat Accounts

Before opening an account, you must choose the correct structure.

NRI Demat Account with NRE

- Fully repatriable

- Best for long-term investors

- Funds can be taken abroad

NRI Demat Account with NRO

- Used for income earned in India

- Limited repatriation

- Common for rent/dividend income

Most NRIs open both, depending on their investment goals.

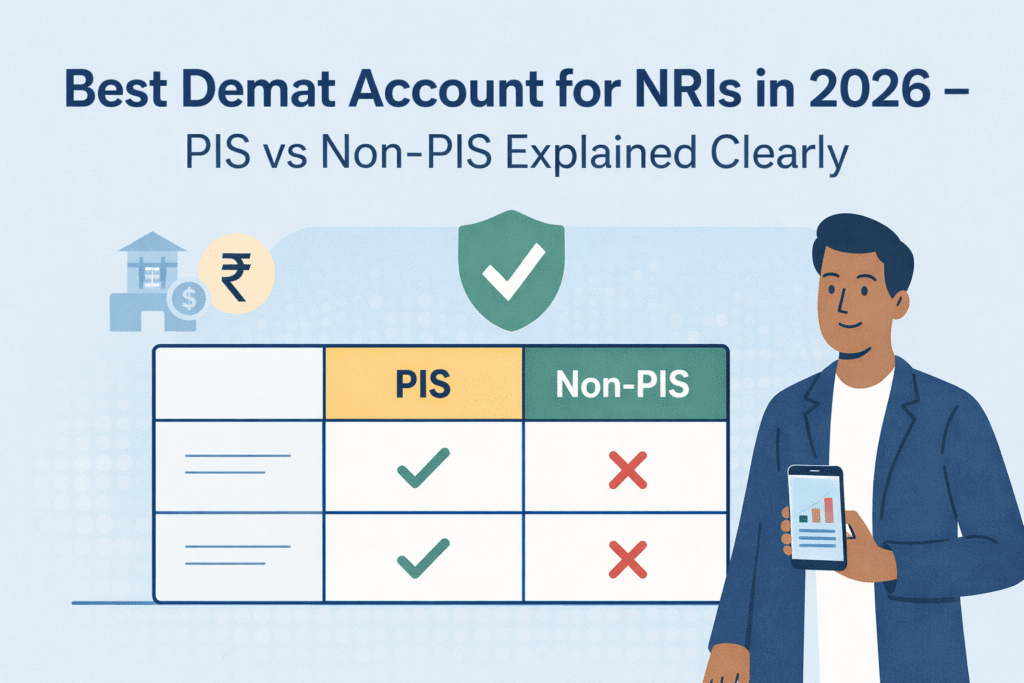

4. PIS vs Non-PIS: Which One Do You Need?

This decision is critical before you open NRI demat account from abroad.

PIS Account

- Required for equity delivery trading

- RBI reporting mandatory

- One bank only

Non-PIS Account

- Used for mutual funds, ETFs

- Simpler compliance

- More flexibility

Many NRIs today open Non-PIS first, then upgrade later.

5. Step-by-Step: How to Open NRI Demat Account from Abroad

Let’s walk through the exact process.

Step 1: Choose the Right Broker

Select a broker experienced with NRI demat account online onboarding.

Step 2: Open NRE/NRO Bank Account

Demat accounts must be linked to NRE or NRO bank accounts.

Step 3: Fill Online Application

Most brokers offer digital forms where you:

- Select NRI status

- Choose PIS or Non-PIS

- Upload documents

Step 4: Upload KYC Documents

This is where many NRIs get confused — we’ll clarify it below.

Step 5: Verification & Activation

Once approved, your demat and trading account goes live.

6. Documents Required for NRI Demat Account Online

Here’s the standard checklist when you open NRI demat account from abroad:

Identity Proof

- Passport (mandatory)

Address Proof (Overseas)

- Utility bill

- Bank statement

- Rental agreement

Indian Address Proof (if applicable)

PAN Card

Bank Proof

- NRE/NRO bank statement

- Cancelled cheque

7. 🔴 IMPORTANT KYC & NOTARISATION CLARIFICATION (UPDATED)

This is extremely important and often misunderstood.

✅ When Notarisation Is NOT Required

If your customer KYC is already verified as an NRI, then notarisation is usually NOT required for:

- Indian Passport – first & last page

- Foreign Passport – personal details page

- Overseas address proof

In such cases, self-attested copies are sufficient while you open NRI demat account from abroad.

This applies to many NRIs who already:

- Hold NRE/NRO accounts

- Have updated KYC status

- Previously invested as NRIs

❌ When Notarisation IS Required

Notarisation or attestation may be required if:

- Your KYC is not updated as NRI

- Broker compliance demands it

- Country-specific regulations apply

So always check broker instructions before submission.

8. Who Can Attest NRI Documents from Abroad?

If attestation is required for your NRI demat account online, documents can be attested by any ONE of the following in your country of residence:

- Notary Public

- Indian Embassy / Consulate

- Authorized Banker

- Licensed Lawyer

💡 Practical Tip:

For NRIs in the Gulf, UK, US, and Canada, bank attestation is usually fastest and cheapest.

9. How Long Does It Take to Open NRI Demat Account Online?

Timelines vary, but typically:

| Stage | Time |

|---|---|

| Online application | 1 day |

| KYC verification | 2–5 days |

| Account activation | 5–10 working days |

If documents are clear, you can open NRI demat account from abroad within one week.

10. Charges & Fees NRIs Should Know

Typical costs include:

- Account opening fee

- Annual maintenance charge (AMC)

- Brokerage (higher than resident accounts)

- PIS reporting charges (if applicable)

Always check the total cost before finalising.

11. Common Mistakes NRIs Make

- Using resident demat account

- Choosing wrong bank linkage

- Ignoring PIS requirement

- Submitting unnecessary notarised documents

- Not updating KYC properly

Avoiding these helps you open NRI demat account online smoothly.

12. Real-Life Example

Ajay, an NRI in Qatar, opened his NRI demat account online without notarisation because his KYC was already updated as NRI. He uploaded self-attested passport pages and overseas address proof — account activated in 6 working days.

That’s how simple it can be when done right.

13. FAQs – Open NRI Demat Account from Abroad

Can I open NRI demat account from abroad fully online?

Yes, most brokers allow online onboarding.

Is notarisation mandatory?

No, not if your KYC is already verified as NRI.

Can I use foreign passport?

Yes, personal details page is required.

Can I invest immediately after account opening?

Yes, once trading is enabled.

14. Final Thoughts

Opening an NRI demat account doesn’t have to be complicated.

With correct documents, updated KYC, and the right broker, you can easily open NRI demat account from abroad and start investing in India — without stress, confusion, or unnecessary paperwork.

If you’re serious about long-term wealth creation in India, NRI demat account online is your first and most important step.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Please consult a SEBI-registered advisor before investing.

Pingback: DTAA for NRI Trading: Your Tax Impact Explained - myfinteche.com

Pingback: Indian Stock Market Basics for NRIs – A Simple guide - myfinteche.com