Best Broker for NRI Trading in India (2026) | Brokerage Charges Comparison

Best Broker for NRI Trading in India – A Complete 2026 Guide

If you’re an NRI, chances are you’ve asked this question at least once:

“Which is the best broker for NRI trading in India?”

You earn abroad, your expenses are abroad, but your investments? They often lead back to India. Whether it’s equity investing, long-term wealth creation, or active trading, choosing the best broker for NRI trading can make or break your experience.

Unfortunately, many NRIs jump in without fully understanding NRI brokerage charges comparison, compliance rules, or operational challenges. As a result, they end up paying higher charges, facing delays, or struggling with customer support.

So let’s fix that.

In this detailed guide, I’ll walk you through everything you need to know—clearly, honestly, and practically—so you can confidently choose the best broker for NRI trading in India without confusion.

📌 Table of Contents

- Why Choosing the Right Broker Matters for NRIs

- Understanding NRI Trading in India

- What Makes the Best Broker for NRI Trading?

- Types of Brokers Available for NRIs

- Full NRI Brokerage Charges Comparison

- Top Brokers for NRI Trading in India

- PIS vs Non-PIS Accounts – Broker Impact

- Hidden Charges NRIs Must Watch Out For

- Real-Life NRI Example

- How to Choose the Best Broker for Your Needs

- FAQs – Best Broker for NRI Trading in India

- Final Verdict

1. Why Choosing the Right Broker Matters for NRIs

To begin with, NRI trading isn’t the same as resident Indian trading.

There are extra regulations, RBI reporting, FEMA compliance, and often—higher charges. That’s exactly why choosing the best broker for NRI trading is not just about convenience; it’s about long-term cost control.

Moreover, a poor broker choice can lead to:

- Delayed trade execution

- High brokerage charges

- Complicated documentation

- Poor customer support

Therefore, doing a proper NRI brokerage charges comparison before opening an account is absolutely essential.

2. Understanding NRI Trading in India

Before we talk about the best broker for NRI trading, let’s quickly understand what NRI trading actually means.

NRIs can invest in:

- Equity shares

- ETFs

- Mutual funds

- IPOs

- Bonds (with restrictions)

However, NRIs cannot do intraday trading in the cash segment. Delivery-based trades are allowed, and derivatives trading is allowed under specific conditions.

Because of these rules, the broker you choose must be experienced in handling NRI compliance smoothly.

3. What Makes the Best Broker for NRI Trading?

Now let’s get to the heart of the matter.

A broker doesn’t become the best broker for NRI trading just because it’s popular. Instead, it must tick these boxes:

✅ Key Criteria

- Dedicated NRI desk

- Clear NRI brokerage charges comparison

- PIS & Non-PIS support

- Easy account opening from abroad

- Transparent pricing

- Responsive customer service

In short, the best broker for NRI trading is one that simplifies complexity, not adds to it.

4. Types of Brokers Available for NRIs

Broadly speaking, there are two types of brokers NRIs can choose from.

🔹 Full-Service Brokers

These include traditional banks and financial institutions.

Pros:

- Relationship manager support

- Offline assistance

- Trust factor

Cons:

- Higher brokerage

- More paperwork

🔹 Discount Brokers

Online-first brokers offering lower costs.

Pros:

- Lower brokerage

- Tech-friendly platforms

- Faster onboarding

Cons:

- Limited hand-holding

When doing an NRI brokerage charges comparison, this distinction becomes very important.

5. NRI Brokerage Charges Comparison (Detailed)

Let’s now address the most searched topic: NRI brokerage charges comparison.

Here’s a simplified overview (charges vary by broker):

📊 Typical Brokerage Structure

| Transaction Type | Brokerage Range |

|---|---|

| Equity Delivery | 0.5% – 1% |

| Futures | ₹100 – ₹500 per lot |

| Options | ₹100 – ₹300 per lot |

| PIS Reporting | ₹500 – ₹1,000 per trade |

| Annual Maintenance | ₹2,000 – ₹5,000 |

This is why NRI brokerage charges comparison must always be done before choosing the best broker for NRI trading.

6. Top Brokers for NRI Trading in India

Based on features, pricing, and NRI experience, here are commonly preferred brokers.

🔹 Broker 1: Traditional Bank Broker

Best for NRIs who want offline support and trust.

- High brokerage

- Smooth PIS handling

- Ideal for long-term investors

🔹 Broker 2: Mid-Size Brokerage Firm

Balanced option for cost and service.

- Moderate brokerage

- Dedicated NRI support

- Faster execution

🔹 Broker 3: Online-Focused Broker

Best for tech-savvy NRIs.

- Competitive pricing

- Transparent NRI brokerage charges comparison

- Online account opening

Choosing the best broker for NRI trading depends on your comfort level, trading frequency, and budget.

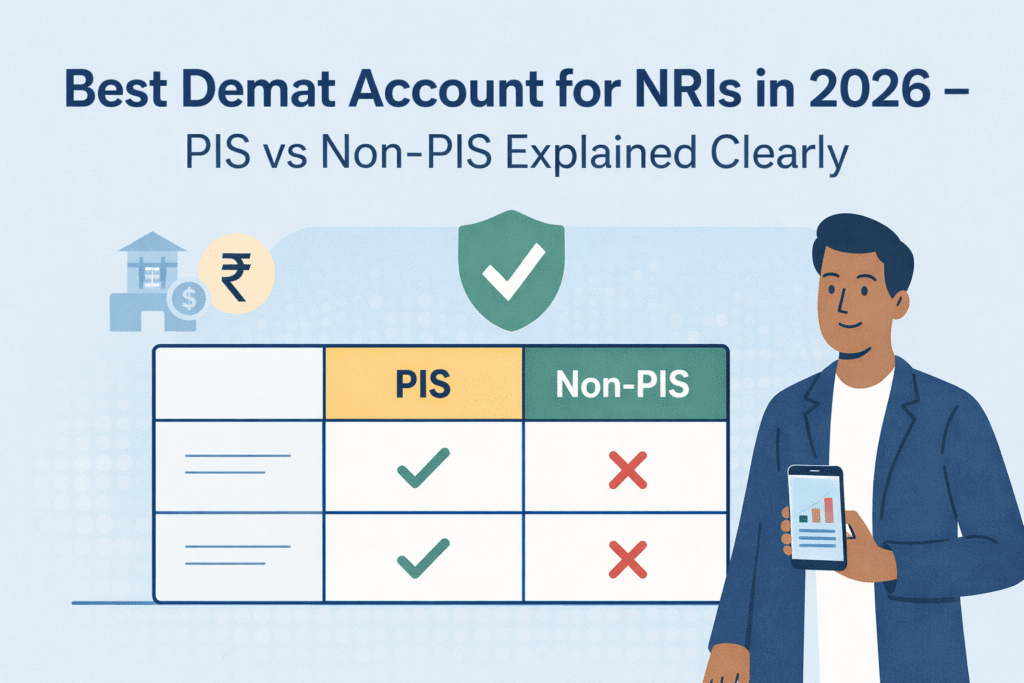

7. PIS vs Non-PIS Accounts – Why Broker Choice Matters

Not all brokers handle both account types efficiently.

- PIS Account: Requires RBI reporting for every trade

- Non-PIS Account: Used mainly for mutual funds & derivatives

The best broker for NRI trading will clearly explain:

- Which account suits you

- Applicable charges

- Operational differences

Otherwise, confusion is guaranteed.

8. Hidden Charges NRIs Must Watch Out For

Here’s where many NRIs get surprised.

Even after doing an NRI brokerage charges comparison, some costs remain hidden:

- Custodian charges

- Forex conversion margins

- Transaction reporting fees

- Platform usage fees

Therefore, always ask for a complete fee sheet before finalizing the best broker for NRI trading.

9. Real-Life NRI Example

Let’s take a relatable example.

Rajesh works in Qatar. He opened an NRI trading account with a high-cost broker without checking an NRI brokerage charges comparison. After one year, he realized brokerage alone ate into 12% of his profits.

Later, he switched to a broker with lower charges and better transparency. His returns improved immediately—not because of better stocks, but because of a better broker.

Lesson? Choosing the best broker for NRI trading saves money silently, year after year.

10. How to Choose the Best Broker for Your Needs

Here’s a quick checklist:

- Long-term investor? Choose stability

- Frequent trader? Focus on charges

- Living abroad long-term? Choose strong online support

- Want peace of mind? Choose NRI-specialized brokers

When you align your goals with a proper NRI brokerage charges comparison, the decision becomes clear.

11. FAQs – Best Broker for NRI Trading in India

❓ Which is the best broker for NRI trading in India?

There’s no one-size-fits-all answer. The best broker for NRI trading depends on your investment style, cost sensitivity, and support needs.

❓ Why is NRI brokerage higher than resident accounts?

Because of RBI reporting, FEMA compliance, and operational complexity.

❓ Is NRI brokerage charges comparison really necessary?

Absolutely. Over time, brokerage directly impacts your net returns.

❓ Can NRIs switch brokers?

Yes. NRIs can transfer demat holdings and switch to a better broker anytime.

12. Final Verdict: Choose Smart, Not Fast

To sum up, choosing the best broker for NRI trading is one of the most important decisions you’ll make as an overseas investor.

Don’t rush.

Do a proper NRI brokerage charges comparison.

Ask uncomfortable questions.

Read the fine print.

Because in the long run, the right broker doesn’t just execute trades—it protects your profits.

📌 Disclaimer

This article is for educational purposes only and does not constitute financial advice. Please consult a SEBI-registered advisor before investing.