DTAA for NRI trading is one of the most misunderstood topics among NRIs living in Kuwait and other GCC countries.

If you’re trading Indian shares while earning abroad, chances are you’ve asked this question: “Am I paying tax twice?”

Fortunately, DTAA exists to prevent exactly that. In this guide, we’ll break down DTAA for NRI trading, how it applies to NRI tax on shares in Kuwait, and how you can legally reduce your tax burden without stress or confusion.

In this post, I’ll break it down step-by-step, share real-life examples, and explain how NRIs in Kuwait and GCC can plan taxes on Indian investments without headaches.Before understanding DTAA for NRI trading, every investor must first have a compliant NRI demat account linked with an NRE or NRO bank account.

Table of Contents

- What is DTAA and Why It Matters for NRIs

- Basics of NRI Tax on Shares

- India-Kuwait DTAA – Key Highlights

- How DTAA for NRI Trading Works

- Short-Term vs Long-Term Capital Gains Tax for NRIs

- TDS and DTAA Relief for NRIs

- Filing Taxes as an NRI in Kuwait / GCC

- Real-Life Examples

- Common Mistakes NRIs Make

- FAQs – DTAA & NRI Share Trading

- Final Thoughts

1. What Is DTAA for NRI Trading?

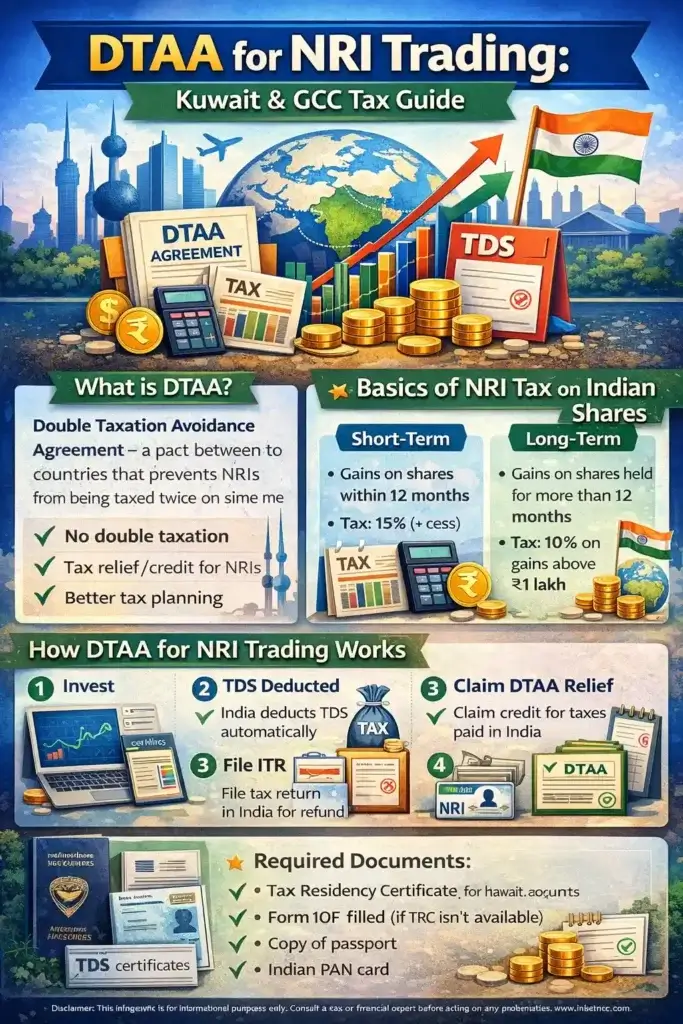

DTAA, or Double Taxation Avoidance Agreement, is a pact between two countries to prevent income from being taxed twice.

For NRIs in Kuwait:

- Without DTAA, NRI tax on shares is deducted in India, and Kuwait taxes global income.

- With DTAA, you can claim credit for taxes paid in India, avoiding double taxation.

Think of it as a bridge that helps your investments work smarter, not harder.

2. Basics of NRI Tax on Shares

Before diving into DTAA, let’s understand how NRI tax on shares functions:

- Short-Term Capital Gains (STCG):

- Selling equity shares within 12 months

- Tax rate: 15% (plus cess & surcharge)

- TDS deducted at source

- Long-Term Capital Gains (LTCG):

- Selling equity shares after 12 months

- Tax rate: 10% on gains exceeding ₹1 lakh

- TDS applies

- Non-Equity Assets:

- Debt mutual funds, bonds taxed differently

- STCG: Slab rate

- LTCG: 20% with indexation

Without DTAA, you might pay full Indian tax AND tax in your resident country.

3. India-Kuwait DTAA – Key Highlights

The India-Kuwait DTAA is a relief mechanism for NRIs:

- Income from Indian shares is taxable in India, but Kuwait can adjust the tax credit.

- The agreement prevents the same profit from being taxed twice.

- Applicable for NRIs residing in GCC countries like UAE, Qatar, Oman, Bahrain, Saudi Arabia.

This is why NRIs should never ignore DTAA while planning investments.

4. How DTAA for NRI Trading Works

Here’s the practical step-by-step:

- Invest in Indian Shares via NRE/NRO Account

- Use a PIS account if investing as an NRI

- Tax Deduction at Source (TDS)

- India deducts TDS automatically on STCG and LTCG

- Claim DTAA Benefits in Kuwait

- Report Indian taxes paid

- Claim tax credit to reduce local tax liability

- File Tax Return in India

- Mandatory to claim refund if TDS is more than actual liability

5. Short-Term vs Long-Term Capital Gains Tax for NRIs

Short-Term Gains

- STCG: 15% flat

- TDS deducted automatically

- Example: Buy for ₹2,00,000 → Sell in 6 months for ₹2,50,000 → Tax = ₹7,500

Long-Term Gains

- LTCG: 10% above ₹1 lakh exemption

- TDS deducted automatically

- Example: Gain ₹1,80,000 → Taxable = ₹80,000 → Tax = ₹8,000

DTAA ensures that this tax can be credited against your Kuwait tax, avoiding double deduction.

6. TDS and DTAA Relief for NRIs

TDS is pre-paid tax in India. Even if your actual liability is lower, India deducts TDS:

- Form 67: To claim DTAA relief

- Submit proof of residence and PAN to Indian bank/broker

- Reduce TDS or claim refund while filing ITR

7. Filing Taxes as an NRI in Kuwait / GCC

- Kuwait has no personal income tax, but DTAA ensures compliance with India.

- NRIs must file Indian ITR if TDS was deducted or gains exceed thresholds.

- Keep documents:

- Contract notes

- TDS certificates

- Proof of NRI status (Passport, Visa)

8. Real-Life Examples

Example 1 – Gulf-Based NRI

- Invests ₹10 lakh in NSE

- STCG: ₹50,000

- TDS deducted: ₹7,500

- Claims DTAA relief → no tax in Kuwait (as zero tax country)

Example 2 – UAE NRI

- LTCG ₹2 lakh

- Exemption ₹1 lakh

- Tax ₹10,000 deducted at source

- Refund claimed via ITR → cash back in NRE account

9. Common Mistakes NRIs Make

- Ignoring DTAA benefits → overpayment of tax

- Not filing Indian ITR → refund stuck

- Confusing STCG & LTCG rules

- Using NRO instead of NRE account for repatriation

Avoid these to maximize your post-tax returns.

10. FAQs – DTAA & NRI Share Trading

Q1: Can NRIs avoid Indian tax completely?

A1: No, tax on NRI shares in India applies. DTAA helps avoid double taxation, not exempt India tax.

Q2: Do NRIs in GCC need to file ITR in India?

A2: Yes, filing ensures TDS refund and DTAA claims.

Q3: What is required to claim DTAA in Kuwait?

A3: Proof of residence, PAN, contract notes, and TDS certificates.

11. Final Thoughts

DTAA is a NRI’s best friend when trading Indian shares from Kuwait or GCC. Understanding DTAA for NRI tradingensures that your profits aren’t unnecessarily taxed twice.

Plan early, document correctly, and always file Indian ITR. This way, NRI tax on shares works in your favor, letting your investments grow without surprises.