Confused between NRI SIP India and NRI mutual fund lumpsum investments? This detailed 2025 guide compares SIP vs lumpsum for NRIs with examples, tax rules, FAQs, and practical insights.

Table of Contents

- Introduction – A Real NRI Dilemma

- Understanding Mutual Fund Investments for NRIs

- What Is SIP for NRIs?

- What Is Lumpsum Investment for NRIs?

- NRI SIP India – How It Works in Practice

- NRI Mutual Fund Lumpsum – How It Works in Practice

- SIP vs Lumpsum – Key Differences at a Glance

- Return Comparison with Real-World Examples

- Market Timing vs Time in the Market

- Risk Management for NRIs

- Taxation Rules for NRIs – SIP vs Lumpsum

- Repatriation and Compliance Considerations

- Which Option Suits Which Type of NRI?

- Common Mistakes NRIs Make

- SIP + Lumpsum – Can You Combine Both?

- FAQs

- Final Verdict – Which Is Better for You?

Introduction – A Real NRI Dilemma

If you’re an NRI earning in dirhams, dollars, or riyals, this question has probably crossed your mind more than once: Should I invest through SIP or put a lumpsum amount in Indian mutual funds? Honestly, you’re not alone. Almost every NRI I speak to faces this exact confusion.

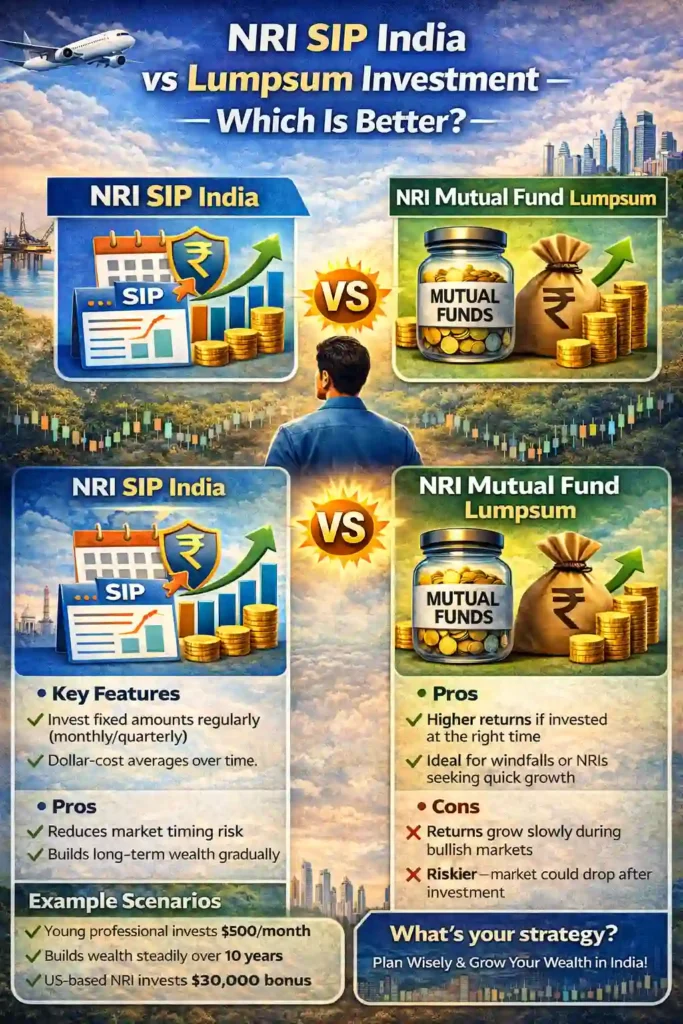

On one hand, NRI SIP India feels disciplined and safe. On the other hand, NRI mutual fund lumpsum looks tempting when you have surplus savings or a bonus. So, which one is actually better? Well, let’s break it down slowly, practically, and without jargon.

Understanding Mutual Fund Investments for NRIs

Before comparing SIP and lumpsum, let’s align on basics. NRIs can legally invest in Indian mutual funds under FEMA regulations. Investments can be made using:

- NRE account

- NRO account

- FCNR account (via conversion)

Most AMCs support both NRI SIP India investments and NRI mutual fund lumpsum investments. However, compliance, taxation, and strategy matter a lot.

What Is SIP for NRIs?

A Systematic Investment Plan, or SIP, allows you to invest a fixed amount every month or quarter into a mutual fund. For NRIs, NRI SIP India works exactly like it does for residents, except payments are routed through NRE or NRO accounts.

Why SIP Feels Comfortable

- You don’t need to time the market

- You invest gradually

- Market volatility averages out

For many NRIs with monthly salaries, NRI SIP India feels natural and stress-free.

What Is Lumpsum Investment for NRIs?

A lumpsum investment means investing a large amount at one go. NRIs usually opt for NRI mutual fund lumpsuminvestments when:

- They receive bonuses or end-of-service benefits

- They sell property abroad

- They repatriate funds to India

Unlike SIPs, lumpsum investments depend heavily on market timing.

NRI SIP India – How It Works in Practice

Let’s say you’re working in Kuwait and earning a stable salary. Every month, you decide to invest ₹25,000 through NRI SIP India into an equity mutual fund.

Over time:

- You buy more units when markets fall

- You buy fewer units when markets rise

- Your average cost evens out

This strategy is called rupee cost averaging, and it’s the biggest strength of NRI SIP India.

NRI Mutual Fund Lumpsum – How It Works in Practice

Now imagine you received ₹10 lakhs as a bonus. Instead of parking it in savings, you invest it as an NRI mutual fund lumpsum.

If markets rise soon after, great. If they fall, your portfolio takes a hit. That’s why NRI mutual fund lumpsum requires emotional control and market awareness.

SIP vs Lumpsum – Key Differences at a Glance

| Feature | NRI SIP India | NRI Mutual Fund Lumpsum |

|---|---|---|

| Investment Style | Periodic | One-time |

| Market Timing | Not required | Important |

| Risk Level | Lower | Higher |

| Best For | Salaried NRIs | NRIs with surplus funds |

| Volatility Impact | Averaged | Direct |

Return Comparison with Real-World Examples

Let’s compare returns.

Example 1: NRI SIP India

- Monthly SIP: ₹20,000

- Duration: 10 years

- Total investment: ₹24 lakhs

- Approx value at 12% CAGR: ₹46–48 lakhs

Example 2: NRI Mutual Fund Lumpsum

- Lumpsum investment: ₹24 lakhs

- Duration: 10 years

- Value at 12% CAGR: ₹74 lakhs

Yes, NRI mutual fund lumpsum can generate higher returns. But it assumes perfect timing, which rarely happens.

Market Timing vs Time in the Market

Here’s the truth. NRIs are busy. Different time zones. Family responsibilities. Career pressure.

That’s why NRI SIP India focuses on time in the market, not timing the market. Meanwhile, NRI mutual fund lumpsum bets on timing, which is risky.

So ask yourself: Do I really have the time to track Indian markets daily?

Risk Management for NRIs

Risk matters more when you’re far from India. With NRI SIP India, risk is spread out. With NRI mutual fund lumpsum, risk hits instantly.

Therefore:

- Conservative NRIs prefer SIP

- Aggressive NRIs may choose lumpsum

Taxation Rules for NRIs – SIP vs Lumpsum

Good news first. Taxation is the same for SIP and lumpsum. The difference lies in holding period.

Equity Funds

- Short-term (<1 year): 15% tax

- Long-term (>1 year): 10% above ₹1 lakh

Debt Funds

- Taxed as per slab rate

Both NRI SIP India and NRI mutual fund lumpsum are subject to TDS.

Repatriation and Compliance Considerations

NRIs investing through NRE accounts can repatriate funds freely. However, investments through NRO accounts have limits.

This applies equally to NRI SIP India and NRI mutual fund lumpsum investments.

Which Option Suits Which Type of NRI?

Choose NRI SIP India if:

- You earn monthly income

- You dislike volatility

- You want discipline

Choose NRI mutual fund lumpsum if:

- You have idle cash

- You understand market cycles

- You can stay invested long-term

Common Mistakes NRIs Make

- Investing lumpsum at market peaks

- Stopping SIPs during market crashes

- Ignoring taxation

- Not aligning investments with goals

Avoid these mistakes whether you choose NRI SIP India or NRI mutual fund lumpsum.

SIP + Lumpsum – Can You Combine Both?

Absolutely. In fact, many smart NRIs do exactly this.

- SIP for regular investing

- Lumpsum during market corrections

This hybrid strategy balances risk and return beautifully.

FAQs

Is NRI SIP India better than lumpsum?

For most NRIs, yes. NRI SIP India offers stability and discipline.

Can NRIs switch from SIP to lumpsum later?

Yes, both options are flexible.

Is lumpsum risky for NRIs?

NRI mutual fund lumpsum carries higher short-term risk.

Final Verdict – Which Is Better for You?

There’s no universal winner. However, for busy NRIs, NRI SIP India usually wins because it’s simple, disciplined, and emotionally easier.

That said, NRI mutual fund lumpsum can boost returns when used wisely. The smartest approach? Combine both and stay invested.

If you’re still confused, remember this: Consistency beats timing. Always.

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing.