Looking for the best demat account for NRIs in 2025? This in-depth guide explains PIS vs Non-PIS accounts, charges, banks, brokers, tax rules, and how NRIs can invest smartly in India.

If you’re an NRI thinking about investing in Indian stocks in 2026, you’ve probably asked yourself this question:

“Which is the best demat account for NRIs – PIS or Non-PIS?”

And honestly, you’re not alone.

As an NRI living abroad, juggling foreign income, Indian savings, and future retirement plans, choosing the best demat account for NRIs isn’t just about low brokerage. It’s about compliance, taxation, repatriation, RBI rules, and of course, peace of mind.

In this detailed guide, I’ll break down PIS vs Non-PIS in simple language, share real-world examples, and help you confidently choose the best demat account for NRIs in 2026—without headaches later.

Let’s get into it.

Table of Contents

- Why NRIs Need a Special Demat Account

- What Is a Demat Account for NRIs?

- Understanding PIS vs Non-PIS (Simple Explanation)

- What Is a PIS Demat Account?

- What Is a Non-PIS Demat Account?

- PIS vs Non-PIS: Side-by-Side Comparison

- Best Demat Account for NRIs – PIS Option (Top Providers)

- Best Demat Account for NRIs – Non-PIS Option (Top Providers)

- Charges & Hidden Costs NRIs Must Know

- Taxation Rules for NRIs (PIS vs Non-PIS Impact)

- Repatriation Rules Explained

- Which Is the Best Demat Account for NRIs in 2026?

- Common Mistakes NRIs Make

- FAQs

1. Why NRIs Need a Special Demat Account

Here’s the thing most new NRIs don’t realise.

Once your residential status changes from Resident Indian to NRI, your regular demat account becomes invalid for stock market investments. RBI and FEMA rules are strict about this.

So, if you want to invest legally, you must open a demat account designed specifically for NRIs.

That’s where the best demat account for NRIs comes into play—and where the confusion around PIS vs Non-PIS begins.

2. What Is a Demat Account for NRIs?

A demat account for NRIs is similar to a regular demat account, but with additional RBI-mandated layers.

It is linked to:

- NRE or NRO bank account

- FEMA compliance

- RBI reporting (for PIS)

Choosing the best demat account for NRIs means choosing the right structure—not just the broker.

3. Understanding PIS vs Non-PIS (Simple Explanation)

Let me simplify PIS vs Non-PIS with a real-life analogy.

Think of PIS as:

“RBI watching every equity transaction you make.”

Think of Non-PIS as:

“No RBI tracking needed because equity isn’t involved.”

Still confused? Don’t worry—let’s break it down properly.

4. What Is a PIS Demat Account?

PIS stands for Portfolio Investment Scheme.

Under this scheme:

- RBI monitors NRI investments in Indian equity shares

- Each buy/sell transaction is reported via your bank

- You can invest only through one designated bank

Key Features of PIS

- Mandatory for equity delivery trading

- Linked to NRE or NRO account

- RBI approval required

- Higher compliance

If your goal is long-term equity investing, PIS is unavoidable. That’s why many investors still choose PIS when searching for the best demat account for NRIs.

5. What Is a Non-PIS Demat Account?

Non-PIS is simpler and lighter.

Under Non-PIS:

- No RBI reporting

- No PIS approval

- Fewer restrictions

What You Can Invest In Using Non-PIS

- Mutual funds

- ETFs

- Bonds

- IPOs

- Equity (non-repatriable, via NRO only)

For many NRIs, Non-PIS wins hands-down due to simplicity and lower costs—especially when comparing PIS vs Non-PIS.

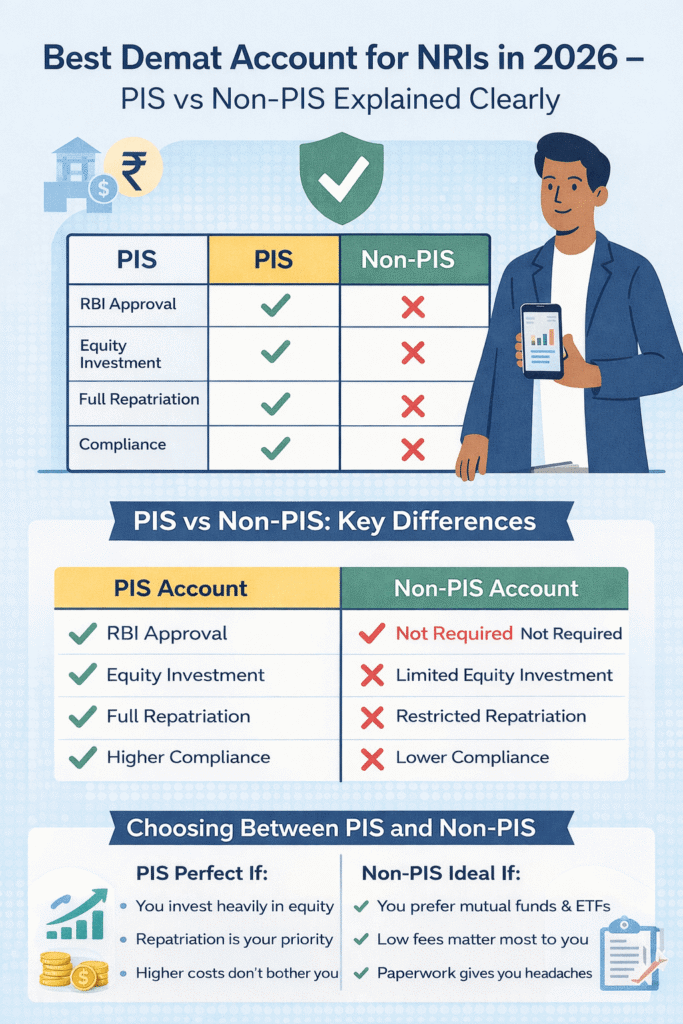

6. PIS vs Non-PIS: Side-by-Side Comparison

| Feature | PIS Account | Non-PIS Account |

|---|---|---|

| RBI Approval | Required | Not Required |

| Equity Delivery | Yes | Limited |

| Repatriation | Allowed (NRE) | Restricted |

| Compliance | High | Low |

| Bank Dependency | Mandatory | Optional |

| Cost | Higher | Lower |

This table alone helps many NRIs decide the best demat account for NRIs based on their needs.

7. Best Demat Account for NRIs – PIS Option

If you’ve decided PIS is right, here are the best demat account for NRIs (PIS-enabled):

Top PIS Providers

- ICICI Direct NRI

- HDFC Securities NRI

- Kotak Securities NRI

- Axis Direct NRI

Pros

- Seamless bank integration

- Strong compliance

- Ideal for large portfolios

Cons

- Higher brokerage

- Annual PIS charges

- Slower execution

If safety > cost for you, PIS works.

8. Best Demat Account for NRIs – Non-PIS Option

Now comes the surprise.

For most NRIs, Non-PIS is actually the best demat account for NRIs in 2026.

Top Non-PIS Brokers

- Zerodha (NRI Non-PIS)

- Upstox NRI

- Groww (Mutual Fund focused)

- Fyers NRI

Why NRIs Love Non-PIS

- Lower brokerage

- Faster execution

- Minimal paperwork

When comparing PIS vs Non-PIS, this is where Non-PIS shines.

9. Charges & Hidden Costs NRIs Must Know

Here’s where many NRIs get shocked.

PIS Costs

- PIS approval fee

- Annual maintenance

- Bank reporting charges

Non-PIS Costs

- Regular AMC

- Brokerage only

If cost matters (and it should), Non-PIS often becomes the best demat account for NRIs.

10. Taxation Rules for NRIs (PIS vs Non-PIS Impact)

Tax rules don’t change much between PIS vs Non-PIS, but the deduction method does.

- TDS is auto-deducted

- Capital gains tax applies

- DTAA benefits available

Regardless of which you choose, tax planning is crucial when selecting the best demat account for NRIs.

11. Repatriation Rules Explained

This is critical.

- NRE + PIS → Full repatriation allowed

- NRO + Non-PIS → ₹1 million/year limit

If you plan to move money abroad, PIS wins in the PIS vs Non-PIS debate.

12. Which Is the Best Demat Account for NRIs in 2026?

Let’s be practical.

Choose PIS if:

- You invest heavily in equity

- Repatriation is important

- You want strict compliance

Choose Non-PIS if:

- You prefer mutual funds & ETFs

- You want low cost

- You hate paperwork (who doesn’t?)

For most NRIs, Non-PIS is the best demat account for NRIs in 2026.

13. Common Mistakes NRIs Make

- Using resident demat account

- Ignoring PIS rules

- Choosing bank brokers blindly

- Not understanding PIS vs Non-PIS

Avoid these, and you’ll already be ahead of 80% of investors.

14. FAQs

Is PIS mandatory for NRIs?

Only for direct equity delivery trades.

Can NRIs trade intraday?

Yes, but conditions apply.

Which is cheaper: PIS vs Non-PIS?

Non-PIS, almost always.

Can I have both PIS and Non-PIS?

Yes, many NRIs do.

Final Thoughts

Choosing the best demat account for NRIs isn’t about trends—it’s about your goals, your income, and your future plans.

Understanding PIS vs Non-PIS clearly gives you control, confidence, and compliance.

If you’re an NRI serious about Indian investments in 2026, make this decision carefully—because the right demat account makes everything else easier.

Pingback: Can NRI invest in Indian stock market?

Pingback: NRI Demat Documents: Complete KYC Checklist for 2026 - myfinteche.com

Pingback: How easily can Open NRI Demat Account from Abroad - myfinteche.com