Can NRI invest in Indian stock market? Yes. Learn NRI investment rules India, PIS vs Non-PIS, taxation, Demat Accounts, and step-by-step process explained.

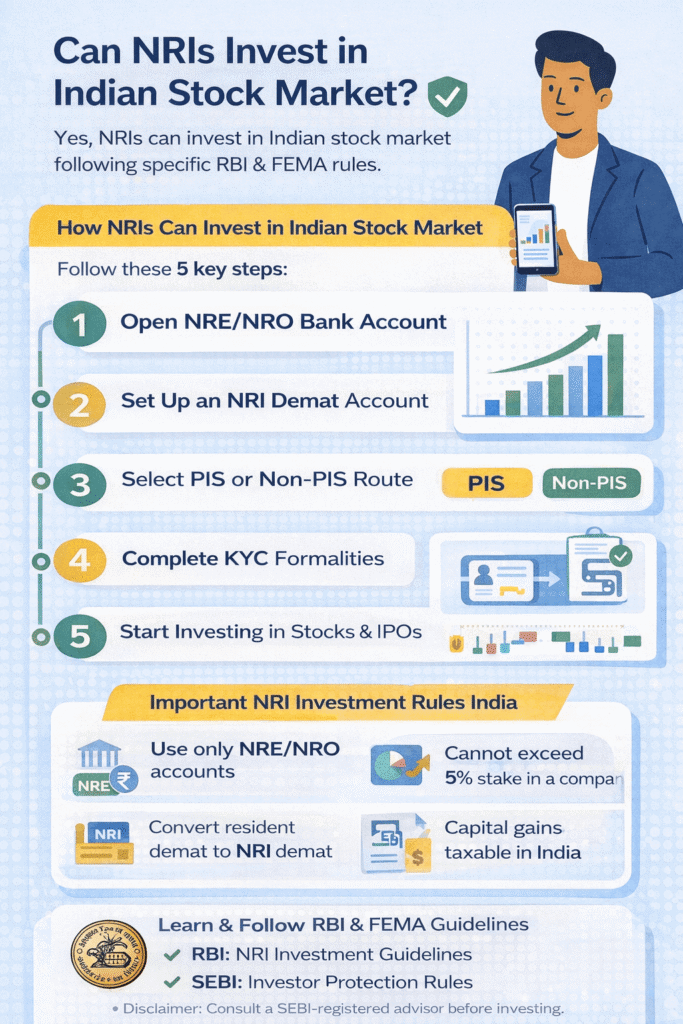

Can NRIs Invest in Indian Stock Market?

If you’re an NRI, this question probably pops up every time the Sensex hits a new high:

Can NRI invest in Indian stock market legally and safely?

You may earn abroad, but emotionally—and financially—India still feels like home. Naturally, you want exposure to India’s growth story. That’s exactly why understanding can NRI invest in Indian stock market and NRI investment rules India is so important.

Let’s break everything down clearly, without jargon, the way one NRI would explain it to another.

Can NRI Invest in Indian Stock Market? (Quick Answer)

Yes.

An NRI can invest in Indian stock market, provided the investment follows NRI investment rules India prescribed by RBI and FEMA.

There are no shortcuts—but once the setup is right, investing becomes smooth and fully legal.

Why NRIs Want to Invest in Indian Stock Market

Many NRIs continue to invest in India because:

- India is one of the fastest-growing economies

- Equity markets beat inflation long-term

- Emotional connection with Indian companies

- Rupee depreciation works in your favour

That’s why the question can NRI invest in Indian stock market keeps gaining importance year after year.

Understanding NRI Investment Rules India (Big Picture)

NRI investment rules India are governed by:

- RBI (Reserve Bank of India)

- FEMA (Foreign Exchange Management Act)

- SEBI

In simple terms:

- NRIs cannot use resident bank accounts

- Investments must go through NRE/NRO accounts

- Special demat accounts are mandatory

- Certain trading restrictions apply

Once you understand this framework, the rest is straightforward.

Who Is Considered an NRI for Stock Market Investment?

Under NRI investment rules India, you are an NRI if:

- You live outside India for employment or business

- You stay abroad for more than 182 days in a financial year

- Your residential status has changed under FEMA

Your residency—not your passport—decides whether can NRI invest in Indian stock market applies to you.

Can NRI Invest in Indian Stock Market Directly?

Yes, but not exactly like residents.

NRIs must:

- Open a dedicated NRI demat account

- Link it with NRE or NRO bank account

- Use PIS or Non-PIS route

This is a critical part of NRI investment rules India.

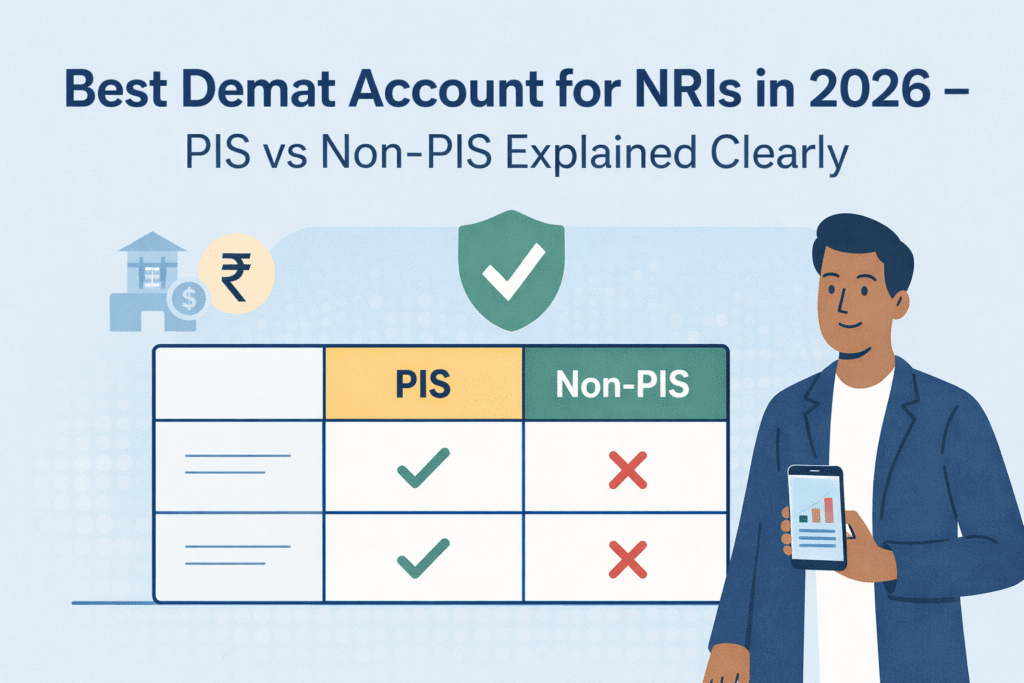

PIS vs Non-PIS Explained Simply

What Is PIS?

PIS (Portfolio Investment Scheme) is an RBI-monitored route that allows NRIs to buy and sell Indian shares.

Used mainly for:

- Direct equity investment

- Delivery-based trading

What Is Non-PIS?

Non-PIS is used for:

- Mutual funds

- ETFs

- Long-term holdings

Choosing correctly is essential when answering can NRI invest in Indian stock market.

Demat Account Options for NRIs

NRIs must open:

- NRE Demat Account (repatriable)

- NRO Demat Account (non-repatriable)

Resident demat accounts must be converted once NRI status changes—mandatory under NRI investment rules India.

Step-by-Step: How NRIs Start Investing

- Convert resident bank account to NRE/NRO

- Open NRI demat + trading account

- Select PIS or Non-PIS route

- Complete KYC

- Start investing on NSE/BSE

That’s the practical answer to can NRI invest in Indian stock market.

Investment Limits Under NRI Investment Rules India

- Individual NRI: Max 5% stake in a company

- All NRIs combined: Max 10%–24%

These limits are strictly monitored.

Taxation Rules for NRI Stock Investments

If you’re worried about tax, here’s clarity:

- Short-term capital gains: Taxable

- Long-term capital gains: Taxable above exemption

- TDS deducted automatically

- DTAA benefits available

Taxation is an integral part of NRI investment rules India.

Repatriation Rules Explained

- NRE investments → Fully repatriable

- NRO investments → Up to USD 1 million/year

Always decide this before investing.

Common Mistakes NRIs Must Avoid

- Using resident demat accounts

- Ignoring FEMA rules

- Choosing wrong PIS route

- Poor tax planning

Avoiding these ensures compliance with NRI investment rules India.

Real-Life NRI Example

Amit, working in Qatar, asked:

“Can NRI invest in Indian stock market while living abroad?”

He opened:

- NRE account

- NRI demat with PIS

Today, Indian equities form his strongest long-term asset.

FAQs – Can NRI Invest in Indian Stock Market?

Can NRI invest in Indian stock market from abroad?

Yes, completely online.

Is RBI permission required?

Only under the PIS route.

Are NRIs allowed intraday trading?

No, as per NRI investment rules India.

Can NRIs invest in IPOs?

Yes, under the same rules.

Final Thoughts

So, can NRI invest in Indian stock market?

Yes—legally, confidently, and profitably.

Once you understand NRI investment rules India, investing becomes systematic and stress-free.

India’s growth story is still unfolding. Living abroad shouldn’t stop you from participating in it.

📌 Disclaimer

This content is for educational purposes only and does not constitute investment advice. Please consult a SEBI-registered financial advisor before investing.

Pingback: Looking for the best demat account for NRIs in 2025? This in-depth guide explains PIS vs Non-PIS accounts,banks, brokers,and how NRIs can invest smartly in India.

Pingback: PIS vs non-PIS Account – A Practical Guide for NRIs - myfinteche.com

Pingback: How easily can Open NRI Demat Account from Abroad - myfinteche.com

Pingback: Tax on NRI Share Trading in India | Capital Gains Explained

Yes,please

Pingback: What is Mutual Fund NRI? How NRIs Can Invest in India Smartly