How Can NRI Trade in the Indian Share Market – A Real NRI’s Step-by-Step Guide.

A practical, human-friendly guide explaining accounts, rules, taxes, brokers, and real NRI experiences.

Table of Contents

- A Personal Introduction: Why NRIs Look Back at India

- Who Exactly Is an NRI (And Why It Matters)

- Can NRIs Really Trade in Indian Share Market?

- How Can NRI Trade in the Indian Share Market – Big Picture

- Accounts You Need (No Escaping This Part)

- Understanding PIS – In Simple Language

- Non-PIS Route – When It Makes Sense

- Demat Account for NRIs (Common Confusion Explained)

- Trading Account Rules NRIs Must Know

- NRE vs NRO – Which One Should You Use?

- Step-by-Step: How Can NRI Trade in the Indian Share Market

- What NRIs Can Invest and Trade In

- What NRIs Cannot Trade In (Hard Truths)

- RBI, FEMA & SEBI Rules – Without Legal Jargon

- Choosing the Right Broker as an NRI

- Charges You’ll Actually Pay

- Taxes on NRI Trading – The Reality

- Repatriation – Getting Your Money Back Abroad

- Mistakes NRIs Often Make (Learn from Others)

- A Real NRI Example from the Gulf

- FAQs NRIs Ask All the Time

- Final Thoughts – Is It Worth It?

1. A Personal Introduction: Why NRIs Look Back at India

If you’re reading this from the Gulf, the US, Europe, or Australia, let me guess—you still check Indian stock prices, don’t you? Even after a long workday abroad, there’s something comforting about opening Moneycontrol or Zerodha Kite and seeing how India’s markets are doing.

That emotional pull is exactly why so many people ask the same question again and again: how can NRI trade in the Indian share market?

India feels familiar. You understand the brands, the economy, the politics, and even the chaos. And honestly, NRI trade in Indian share market has created serious long-term wealth for many people who started early and followed the rules.

But here’s the catch—it’s not as straightforward as it was when you lived in India. Rules change, accounts change, and one wrong step can land you in FEMA trouble. Let’s clear the confusion properly.

2. Who Exactly Is an NRI (And Why It Matters)

Before figuring out how can NRI trade in the Indian share market, you need to know whether you are officially an NRI.

You are treated as an NRI if:

- You stay outside India for more than 182 days in a financial year

- Your income is primarily earned outside India

Once you become an NRI, your old resident savings account, Demat account, and trading account are no longer valid for trading. Many people ignore this—and that’s a big mistake.

3. Can NRIs Really Trade in Indian Share Market?

Yes, NRIs can trade in Indian markets. There’s no doubt about it.

However, NRI trade in Indian share market comes with conditions:

- Delivery-based equity trading is allowed

- Long-term investing is encouraged

- Speculative trading is restricted

If you’re hoping to do fast intraday trades like you see on YouTube reels—sorry, that’s not allowed for NRIs.

4. How Can NRI Trade in the Indian Share Market – Big Picture

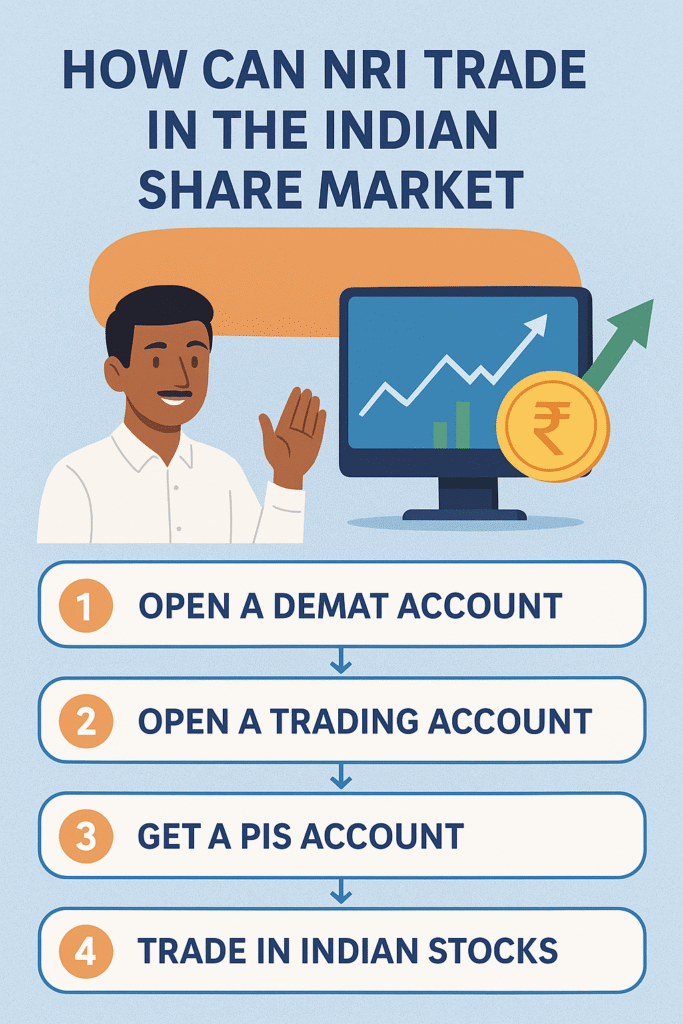

At a high level, here’s how can NRI trade in the Indian share market:

- Accept your NRI status (mentally and legally)

- Open NRE and/or NRO bank accounts

- Open an NRI Demat account

- Open an NRI trading account

- Decide between PIS or Non-PIS route

- Start delivery-based investing

Simple on paper, slightly painful in execution—but totally doable.

5. Accounts You Need (No Escaping This Part)

For proper NRI trade in Indian share market, you need:

- NRE or NRO bank account

- NRI Demat account

- NRI trading account

- PIS approval (for equity delivery)

Yes, paperwork exists. Yes, attestation exists. Welcome to the NRI club.

6. Understanding PIS – In Simple Language

PIS stands for Portfolio Investment Scheme.

Think of PIS as RBI’s way of tracking how NRIs buy and sell Indian shares.

Why PIS Exists

- RBI monitors foreign ownership

- Ensures FEMA compliance

If you want to understand how can NRI trade in the Indian share market legally, PIS is often unavoidable for stock delivery trades.

7. Non-PIS Route – When It Makes Sense

Non-PIS is simpler and often used for:

- Mutual funds

- ETFs

- IPO investments

Many long-term investors prefer this route because it reduces complexity while still allowing NRI trade in Indian share market through funds.

8. Demat Account for NRIs (Common Confusion Explained)

Your Demat account holds shares digitally.

Important things NRIs often miss:

- Resident Demat must be converted to NRI Demat

- Separate Demat accounts for NRE and NRO investments

Without this conversion, NRI trade in Indian share market becomes non-compliant.

9. Trading Account Rules NRIs Must Know

NRI trading accounts are different:

- Delivery only

- No intraday trading

- No margin trading

This surprises many first-time NRIs learning how can NRI trade in the Indian share market.

10. NRE vs NRO – Which One Should You Use?

NRE Account

- Funded from abroad

- Fully repatriable

NRO Account

- Used for Indian income

- Limited repatriation

Most serious investors use both for smooth NRI trade in Indian share market operations.

11. Step-by-Step: How Can NRI Trade in the Indian Share Market

Step 1: Update NRI Status

Inform banks and brokers.

Step 2: Open NRE/NRO Accounts

Choose a bank familiar with NRIs.

Step 3: Apply for PIS

Handled by your bank.

Step 4: Open Demat & Trading Account

Prefer brokers with NRI desks.

Step 5: Fund the Account

Via NRE or NRO transfers.

Step 6: Start Investing

Only delivery-based trades.

That’s literally how can NRI trade in the Indian share market, step by step.

12. What NRIs Can Invest and Trade In

NRIs can invest in:

- Equity shares (delivery)

- Mutual funds

- ETFs

- IPOs

This makes NRI trade in Indian share market ideal for long-term wealth building.

13. What NRIs Cannot Trade In (Hard Truths)

NRIs cannot:

- Do intraday trading

- Trade commodities

- Trade currency derivatives

Accepting these limits makes life easier.

14. RBI, FEMA & SEBI Rules – Without Legal Jargon

Your trading is governed by:

- FEMA regulations

- RBI PIS guidelines

- SEBI rules

Follow them and you’ll never have trouble with NRI trade in Indian share market.

15. Choosing the Right Broker as an NRI

Look for brokers offering:

- Dedicated NRI support

- Clear pricing

- Smooth repatriation

Popular choices include Zerodha, ICICI Direct, and HDFC Securities.

16. Charges You’ll Actually Pay

Expect:

- Brokerage

- DP charges

- Bank PIS fees

- GST

Understanding costs helps you trade smarter.

17. Taxes on NRI Trading – The Reality

Capital Gains

- Short-term: 15%

- Long-term: 10% above limit

TDS

- Automatically deducted

Taxes are unavoidable in NRI trade in Indian share market, but manageable.

18. Repatriation – Getting Your Money Back Abroad

- NRE investments: Fully repatriable

- NRO investments: Up to USD 1 million per year

Plan this properly from day one.

19. Mistakes NRIs Often Make (Learn from Others)

- Using resident accounts

- Ignoring taxes

- Overtrading

Avoid these and you’ll be fine.

20. A Real NRI Example from the Gulf

Ramesh, working in Kuwait, started investing via an NRE-PIS account. He focused on quality stocks and held them patiently. Seven years later, India became his strongest asset base.

That’s how how can NRI trade in the Indian share market looks in real life.

21. FAQs NRIs Ask All the Time

22. Final Thoughts – Is It Worth It?

If you ask me, understanding how can NRI trade in the Indian share market is absolutely worth the effort. With discipline, compliance, and patience, NRI trade in Indian share market can become a powerful long-term wealth engine.

India is still home—financially too.

Pingback: Can NRI invest in Indian stock market?

Pingback: Tax on NRI Share Trading in India | Capital Gains Explained

Pingback: Indian Stock Market Trading for NRIs: Why Every NRI Must Learn It in 2026 - myfinteche.com

Pingback: Indian Stock Market Basics for NRIs – A Simple guide - myfinteche.com