Indian stock market basics explained simply for NRIs. Learn how the Indian stock market works, key players, trading, taxes, and how NRIs can start investing.

📘 Table of Contents

- 🔹 Introduction – Why NRIs Must Understand the Indian Stock Market

- 🔹 What Is the Indian Stock Market? (Simple Explanation)

- 🔹 How Indian Stock Market Works – Step by Step

- 🔹 Key Players in the Indian Stock Market

- 🔹 NSE vs BSE – What’s the Difference?

- 🔹 Market Timings and Trading Sessions in India

- 🔹 Types of Instruments NRIs Can Invest In

- 🔹 How Share Prices Are Decided in India

- 🔹 Role of SEBI in the Indian Stock Market

- 🔹 How NRIs Can Start Investing in Indian Stock Market

- 🔹 Demat, Trading, PIS & Non-PIS Explained

- 🔹 Taxes for NRIs in Indian Stock Market

- 🔹 Common Mistakes NRIs Make (And How to Avoid Them)

- 🔹 Real-Life Example: How an NRI Invests from Abroad

- 🔹 Long-Term vs Trading – What Suits NRIs Better?

- 🔹 FAQs – Indian Stock Market for NRIs

- 🔹 Final Thoughts

Introduction – How the Indian Stock Market Works for NRIs

If you’re an NRI, let’s be honest—you’ve probably wondered how the Indian stock market works and whether it’s really worth your time. You hear words like Nifty, Sensex, IPO, and multibagger everywhere. Meanwhile, your hard-earned money is parked safely but quietly in bank accounts.

So, right at the start, let’s be clear. This guide explains Indian stock market basics for NRIs in the simplest possible way. Step by step. No jargon. No theory overload.

More importantly, this article focuses on how the Indian stock market works in real life—from an NRI’s point of view. If you live abroad and still want to grow wealth in India, you’re exactly where you should be.

Indian Stock Market Basics – Simple Explanation

At its core, the Indian stock market is a place where shares of Indian companies are bought and sold.

When a company needs money to grow, it offers ownership to the public. Investors buy these shares. In return, they become part-owners.

So, when people ask how Indian stock market works, the simple answer is this:

- Companies raise money

- Investors buy ownership

- Prices move based on demand, supply, and performance

For NRIs, the Indian stock market works almost the same way as any global market—just with a few India-specific rules.

How the Indian Stock Market Works – Step by Step

Let’s slow this down and understand how Indian stock market works in a practical flow.

Step 1: Company Lists Its Shares

A company launches an IPO (Initial Public Offering). Shares become available to the public.

Step 2: Shares Are Traded on Exchanges

In India, shares trade mainly on:

Step 3: Buyers and Sellers Meet

When someone wants to buy and someone wants to sell at the same price, a trade happens.

Step 4: Settlement Happens

Shares move to the buyer’s Demat account. Money moves to the seller.

That’s it. That’s how Indian stock market works in real life.

Key Players – How the Indian Stock Market Works Behind the Scenes

To fully understand how Indian stock market works, you need to know the players.

1. Investors

That’s you—the NRI investor.

2. Stock Exchanges

NSE and BSE provide the platform.

3. Brokers

Zerodha, Groww, Upstox, ICICI Direct—brokers execute your trades.

4. Depositories

- NSDL

- CDSL They hold your shares digitally.

5. SEBI

The regulator that keeps the system clean.

NSE vs BSE – How the Indian Stock Market Works Across Exchanges

NRIs often ask: Should I invest in NSE or BSE?

Honestly? It doesn’t matter much.

- NSE is more popular for trading

- BSE is Asia’s oldest exchange

- Prices are almost identical

Both are fully regulated. Both are safe.

Market Timings – How the Indian Stock Market Works Daily

Understanding timings helps you see how Indian stock market works day to day.

- Pre-open: 9:00 – 9:15 AM IST

- Market hours: 9:15 – 3:30 PM IST

- No weekend trading

For NRIs in the Gulf, Europe, or the US, this usually means morning or late-night access.

Investment Options – Indian Stock Market Basics for NRIs

The Indian stock market isn’t just about shares.

NRIs can invest in:

- Equity shares

- Mutual funds

- ETFs

- IPOs

- Bonds

- REITs & InvITs

Yes, NRIs have wide access. The system is more open than most people think.

Price Discovery – How the Indian Stock Market Works

Here’s the honest truth about how Indian stock market works when it comes to prices.

Prices move because of:

- Demand and supply

- Company earnings

- News and events

- Global markets

- Investor emotions

There’s no single controller. It’s a live auction.

SEBI’s Role – Why the Indian Stock Market Works Safely

SEBI is the referee.

It:

- Regulates brokers

- Protects investors

- Prevents fraud

- Ensures transparency

For NRIs, SEBI is the reason the Indian stock market is trustworthy today.

How NRIs Can Start – Indian Stock Market Basics

This is where most confusion exists.

To invest, NRIs need:

- PAN card

- NRE or NRO bank account

- Demat account

- Trading account

Once set up, investing is smooth.

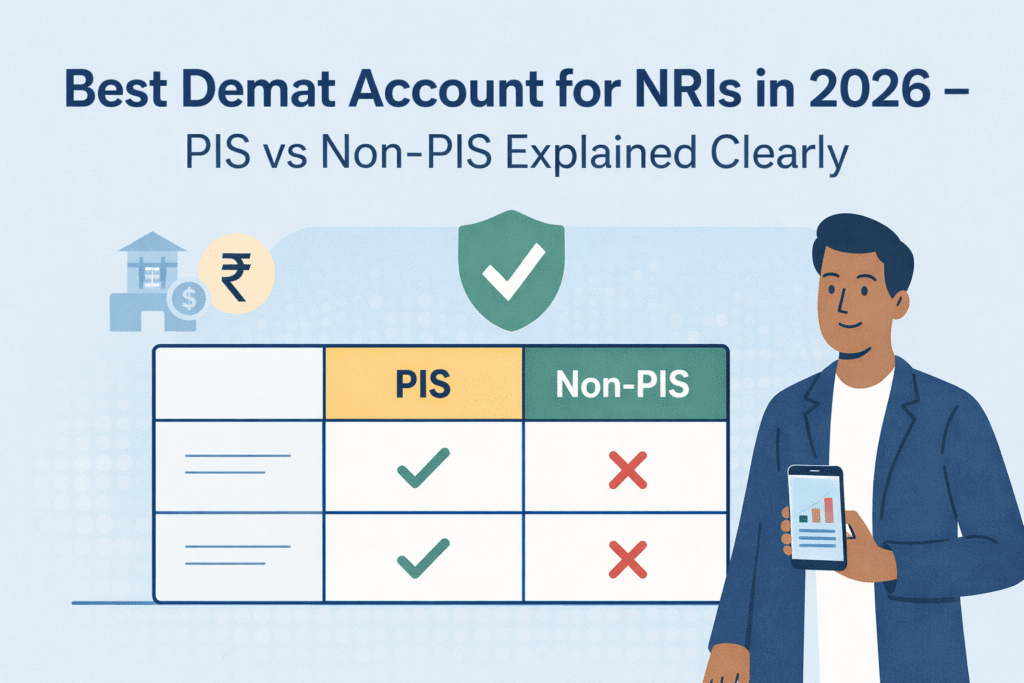

Accounts Explained – How the Indian Stock Market Works for NRIs

Let’s simplify this.

- Demat account: Holds shares

- Trading account: Places orders

- PIS account: RBI reporting route

- Non-PIS: Mutual funds, ETFs

Understanding this clears 80% of doubts about how Indian stock market works for NRIs.

Taxes – How the Indian Stock Market Works for NRIs

Yes, taxes matter.

NRIs pay:

- Capital gains tax

- Dividend tax

TDS is usually deducted automatically. You can claim refunds.

Knowing taxes helps you invest confidently.

Common NRI Mistakes – Understanding Indian Stock Market Basics

Some hard truths:

- Waiting too long

- Overtrading

- Following WhatsApp tips

- Ignoring taxes

The Indian stock market rewards patience. Not shortcuts.

Real-Life Example – How the Indian Stock Market Works for an NRI

Rahul works in Dubai. He invests ₹25,000 monthly via SIP in Indian stocks and ETFs.

In 10 years, his portfolio crosses ₹60 lakhs.

That’s the power of understanding how Indian stock market works.

Investing Style – How the Indian Stock Market Works Best for NRIs

For most NRIs:

- Long-term investing wins

- Trading needs time

- Emotions kill returns

Simple strategy. Big results.

FAQs – Indian Stock Market for NRIs

Is Indian stock market safe for NRIs?

Yes, fully regulated.

Can NRIs trade daily?

Yes, with conditions.

Do NRIs need to be in India?

No.

Is currency risk involved?

Yes, but manageable.

Final Thoughts

If you’ve read this far, you already understand how Indian stock market works better than 90% of NRIs.

Start small. Stay consistent. Think long term.

The Indian stock market isn’t complicated. It’s just poorly explained.

And now? You’re ahead of the curve.

Disclaimer: This article is for educational purposes only. Not investment advice.