Discover the complete guide to NRI investment in gold and gold investment for NRIs — strategies, tax rules, investment options, risks & real examples to grow your wealth smartly in 2026.

📘 Table of Contents

- Introduction

- Why NRIs Love Gold

- What Is NRI Investment in Gold?

- Top Gold Investment Options for NRIs

- Physical Gold

- Gold ETFs & Sovereign Gold Bonds

- Digital Gold

- Benefits of Gold as an NRI Investment

- Risks & Limitations

- Taxation & Regulatory Rules

- How to Choose the Best Gold Investment Option

- Real‑World Examples & Case Studies

- FAQs on Gold Investment for NRIs

- Conclusion

🥇 1. Introduction

Have you ever wondered why nri investment in gold is such a hot topic in expat conversations? If you’re an NRI, like me, this question probably keeps popping up around family weddings, Diwali conversations, or WhatsApp groups. Gold isn’t just jewelry; it’s a financial asset. And whether you’re sending money back home or building long‑term wealth, gold investment for NRIs can play a key role in your portfolio.

Let’s break it down in plain English — no finance jargon that makes your eyes glaze over. I’ll share what works, what doesn’t, and how you can make smart decisions in 2026.

🪙 2. Why NRIs Love Gold

Ask any NRI — especially those with roots in India or the Middle East — and they’ll tell you: gold feels safe. It’s cultural. It’s emotional. It’s traditional. But guess what? It’s also strategic.

Here’s why:

✅ Gold holds value during inflation

✅ It’s liquid — easy to sell when needed

✅ It diversifies risk in your investment portfolio

✅ It’s globally recognized

This is exactly why nri investment in gold remains strong even when stocks or real estate get shaky.

📌 3. What Is NRI Investment in Gold?

At its core, nri investment in gold simply means investing in gold‑linked assets while living abroad. But because you’re an NRI, there are specific rules and products designed for you. You’re not just buying jewelry. You’re investing in financial assets that track the price of gold.

When we talk about gold investment for NRIs, we mean various legal and tax‑efficient ways to buy gold — either physically or digitally — that fit into your global wealth strategy.

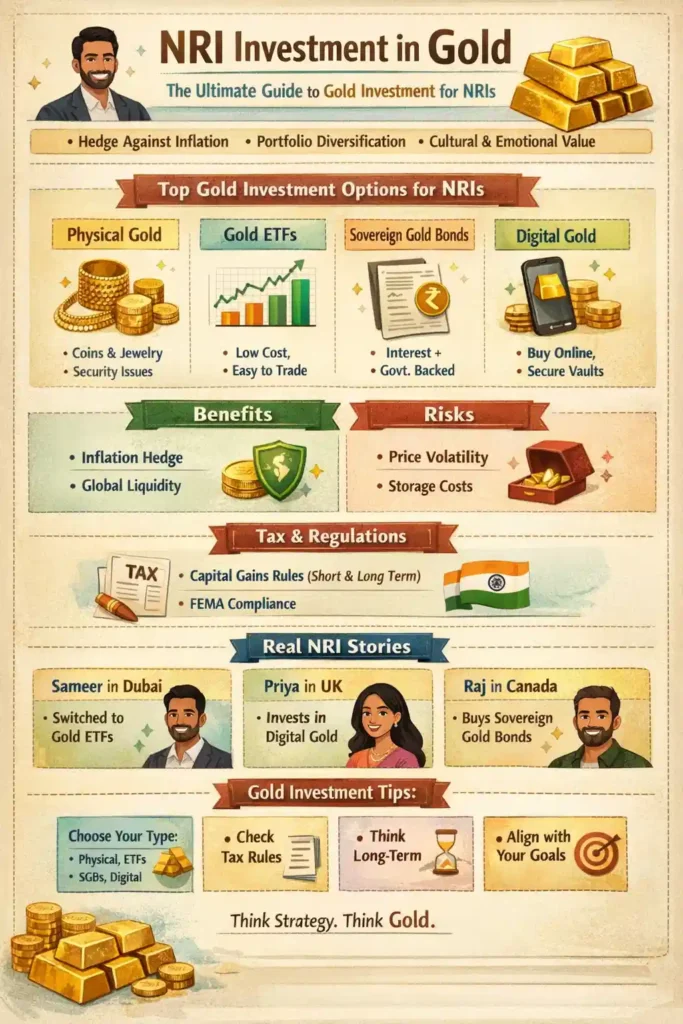

🏆 4. Top Gold Investment Options for NRIs

🟡 4.1 Physical Gold

This is the classic — the one your grandparents swear by.

Forms of Physical Gold:

- Jewelry (rings, necklaces)

- Coins

- Bars (like 10g, 100g)

Pros:

- Tangible and heartfelt — literally beautiful

- Easy to gift at weddings or festivals

Cons:

- Making charges on jewelry

- Storage & security issues

- GST on purchase

So while physical gold is part of gold investment for NRIs, it’s often not the best pure investment due to extra costs.

📈 4.2 Gold ETFs (Exchange‑Traded Funds)

Gold ETFs are one of the most efficient ways for NRIs to invest.

In simple terms, Gold ETFs are funds that track the price of gold. You can buy and sell them like stocks.

Why they’re great:

- Low cost

- No storage issues

- Traded on stock exchanges

- Transparent pricing

If you care about efficiency, this is a top choice in nri investment in gold.

📊 4.3 Sovereign Gold Bonds (SGBs)

These are government‑backed bonds linked to gold prices.

Key Benefits:

- Earn interest (usually ~2.5% per year)

- Backed by the government

- No physical storage needed

For NRIs, gold investment for NRIs using Sovereign Gold Bonds is smart because it adds yield on top of gold price gains.

💻 4.4 Digital Gold

This is a newer way to invest where you buy gold online, stored in secure vaults.

Platforms:

Many apps and fintech services let you buy gold with small amounts.

Why NRIs like it:

- Buy anytime, anywhere

- Low minimums

- Easy to redeem or sell

It’s digital, secure, and fits perfectly in a modern nri investment in gold strategy.

🎯 5. Benefits of Gold as an NRI Investment

Let’s break down the real advantages:

🔹 Hedge Against Inflation

When currencies weaken, gold often holds value. That’s why gold investment for NRIs is often recommended during inflationary times.

🔹 Portfolio Diversification

If you only invest in stocks or real estate, your risk is concentrated. Gold acts differently from stocks, smoothing out ups and downs.

🔹 Global Liquidity

You can sell gold anywhere in the world — India, GCC countries, Europe, North America — this is perfect for NRIs.

🔹 Cultural & Emotional Value

In many cultures, gold isn’t just money — it’s a legacy. So even if markets dip, gold tends to retain emotional value.

⚠️ 6. Risks & Limitations

Nothing is perfect, right? Here are some things to watch out for:

❌ Volatility

Gold prices can be unpredictable in the short term.

❌ No Regular Income (Except SGBs)

Physical gold or ETFs won’t pay dividends. Only SGBs give interest.

❌ Costs & Charges

Jewelry has making charges. Digital platforms might charge fees. ETFs have expense ratios.

So while nri investment in gold is powerful, you have to be smart about how you do it.

💼 7. Taxation & Regulatory Rules for NRIs

Taxes vary depending on where you reside and where you invest. Here’s a simplified view:

📍 India Tax Rules (for NRIs)

- Capital Gains:

- Short‑term if sold within 36 months

- Long‑term after 36 months

- TDS:

- TDS may apply on sale profits

- SGB:

- Exempt from capital gains tax if redeemed on maturity

Some countries (USA, UK, Canada, UAE) treat gold differently for tax. Always check local laws or consult a tax expert.

As you research gold investment for NRIs, don’t skip this step. It can save you serious money.

🧠 8. How to Choose the Best Gold Investment Option

Here’s a simple way to decide:

🔹 If You Want Tangible Gold:

👉 Choose physical gold

🔹 If You Want Low‑Cost, Easy Trading:

👉 Choose Gold ETFs

🔹 If You Want Interest + Price Gains:

👉 Choose Sovereign Gold Bonds

🔹 If You Want Flexible Online Access:

👉 Go with Digital Gold

Always align your choice with your goals and tax situation.

📘 9. Real‑World Examples & Case Studies

Let’s look at a few scenarios to make this real.

🧑💼 Example — Sameer in Dubai

Sameer started with physical gold. Then he shifted to Gold ETFs because:

- It cost him less

- He didn’t need to store it

- He could sell easily during market dips

That’s a perfect evolution in nri investment in gold — moving from emotional holdings to strategic investing.

👩💻 Example — Priya in UK

Priya loves digital platforms. So she invests small amounts in digital gold every month.

Why it works:

- Affordable

- No storage

- Adds up over time

This is modern gold investment for NRIs — flexible and future‑oriented.

💡 Example — Raj in Canada

Raj uses Sovereign Gold Bonds — earns regular interest and benefits when gold prices rise.

That combination is rare. It’s one of the smartest moves in nri investment in gold today.

❓ 10. Frequently Asked Questions (FAQs)

❓ What is the safest form of nri investment in gold?

The safest — both in cost and convenience — is Sovereign Gold Bonds or Gold ETFs, depending on whether you prefer interest or pure price gains.

❓ Can NRIs invest in gold in India?

Yes, NRIs can invest in gold in multiple ways — physical, digital, ETFs, and SGBs — as long as you follow FEMA and tax rules.

❓ Is gold investment for NRIs profitable?

Historically, gold has been a strong hedge and long‑term store of value, especially during economic uncertainty. But like any investment, profits aren’t guaranteed short‑term.

❓ Should I keep physical gold or digital gold?

If you value tradition and gifting, physical gold is fine. But for pure investment without storage headache, digital gold or ETFs are better.

❓ Do NRIs get tax benefits on gold investing?

Tax depends on your residency country and where you invest. In India, SGBs have tax benefits if held till maturity. Always check with a tax advisor.

✅ 11. Conclusion

When it comes to nri investment in gold, you’re not just buying a shiny metal. You’re tapping into centuries of cultural trust and modern financial strategy.

Here’s what you should take away:

✔ Gold diversifies your portfolio

✔ Different forms of gold investment for NRIs have unique benefits

✔ ETFs and SGBs are cost‑efficient and liquid

✔ Tax rules matter — don’t skip them

✔ Your goals should drive your choice

So don’t just grab gold because “everyone else does.” Think long term. Think strategy. Think about how nri investment in gold fits into your wealth journey.