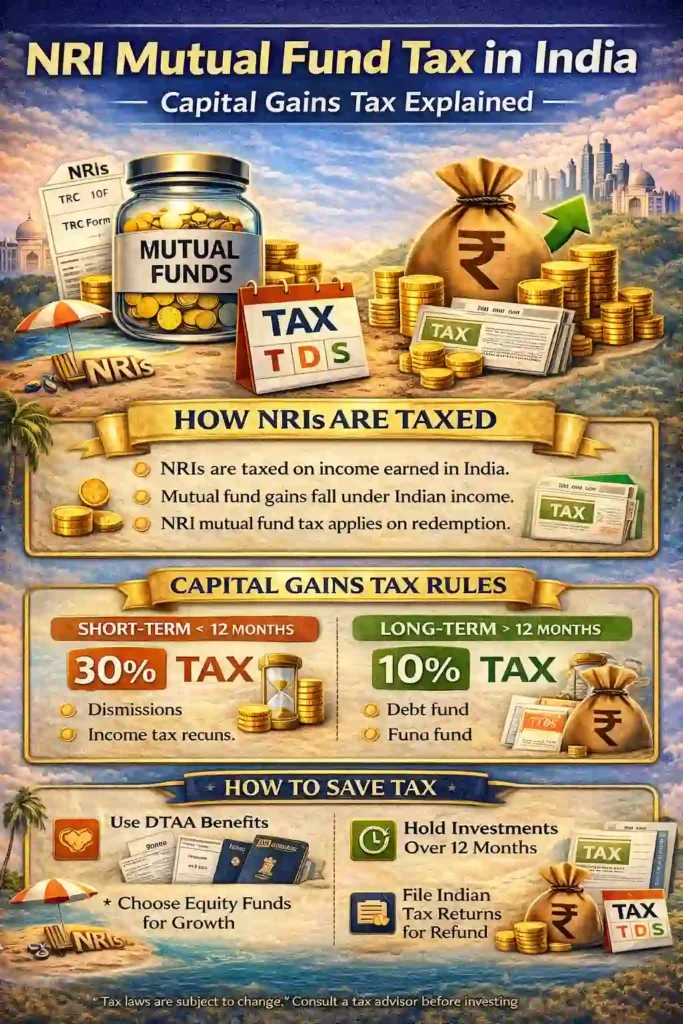

NRI mutual fund tax explained clearly. Learn capital gains tax for NRI mutual funds, TDS rules, DTAA benefits, examples, and FAQs in this 2025 guide.

Tax on Mutual Funds for NRIs in India – A Practical 2025 Guide

Table of Contents

- Introduction – Why NRI Mutual Fund Tax Confuses Everyone

- Basics of NRI Mutual Fund Tax in India

- How Capital Gains Tax for NRI Mutual Funds Works

- Equity Mutual Fund Taxation for NRIs

- Debt Mutual Fund Taxation for NRIs

- Hybrid & International Fund Tax for NRIs

- Short-Term vs Long-Term Capital Gains for NRIs

- TDS on Mutual Funds for NRIs – The Big Shock

- Real-Life Examples of NRI Mutual Fund Tax

- DTAA Benefits for NRIs

- Tax on SIP vs Lumpsum for NRIs

- Repatriation and Tax Compliance

- Common NRI Mutual Fund Tax Mistakes

- Smart Tax-Saving Tips for NRIs

- FAQs on Capital Gains Tax for NRI Mutual Funds

- Final Thoughts – How to Stay Tax Smart as an NRI

Introduction – Why NRI Mutual Fund Tax Confuses Everyone

For many NRIs, choosing mutual funds is easy. On the other hand, understanding taxes feels overwhelming.

Because Indian tax laws treat NRIs differently, capital gains tax for NRI mutual funds often looks higher at first glance. As a result, panic sets in when heavy TDS is deducted during redemption.

That said, here’s the good news. Once you clearly understand how NRI mutual fund tax works, the fear disappears. Moreover, with proper planning, you can legally reduce tax and improve post-tax returns.

So, instead of guessing or avoiding investments, let’s break this topic down step by step. In simple terms, this guide explains capital gains tax for NRI mutual funds exactly the way an NRI investor needs it.

Basics of NRI Mutual Fund Tax in India

First things first.

NRIs are taxed differently from residents. This single point explains most confusion around NRI mutual fund tax.

Under Indian tax law:

- NRIs are taxed on India-sourced income

- Mutual fund gains are considered Indian income

- Hence,the capital gains tax for NRI mutual funds applies

So yes, whether you live in the UAE, US, UK, or Kuwait, Indian mutual fund tax rules still apply.

How Capital Gains Tax for NRI Mutual Funds Works

Before diving deeper, it’s important to understand one thing clearly. NRI mutual fund tax is primarily capital gains tax. In other words, tax applies only when you sell or redeem your investments.

However, capital gains tax for NRI mutual funds is not flat. Instead, it depends on multiple factors. For example, the type of fund matters. Similarly, the holding period plays a major role.

Because of this structure, two NRIs investing the same amount may end up paying very different taxes. Moreover, the presence of TDS often makes the tax look higher than it actually is.

Therefore, understanding how capital gains tax for NRI mutual funds is calculated helps you plan exits better. Most importantly, it prevents unnecessary surprises later.

Equity Mutual Fund Taxation for NRIs

Equity funds are popular among NRIs. However, NRI mutual fund tax on equity funds follows strict rules.

Holding Period Rules

- Short-term: Less than 12 months

- Long-term: More than 12 months

Capital Gains Tax for NRI Mutual Funds (Equity)

| Type | Tax Rate |

|---|---|

| Short-term | 15% |

| Long-term | 10% above ₹1 lakh |

Yes, NRIs get the same rates as residents.

But here’s the catch…

👉 TDS is deducted upfront, even for long-term gains.

This is why NRI mutual fund tax feels heavier, although the actual tax may not be.

Debt Mutual Fund Taxation for NRIs

Debt funds are where most NRIs get shocked.

Earlier, long-term debt funds had indexation.

Now, after rule changes, debt fund taxation for NRIs is harsher.

Capital Gains Tax for NRI Mutual Funds (Debt)

- All gains are taxed as per the slab

- No indexation benefit

- TDS applies at the slab rate

So, if you’re in the highest slab, NRI mutual fund tax on debt funds can go up to 30%+.

Hybrid & International Fund Tax for NRIs

Hybrid funds are tricky.

Tax depends on equity exposure.

- Equity > 65% → Equity taxation

- Equity < 65% → Debt taxation

International funds?

They’re treated like debt funds, meaning higher NRI mutual fund tax.

Short-Term vs Long-Term Capital Gains for NRIs

This distinction is critical.

Many NRIs ignore holding periods.

That’s costly.

Capital gains tax for NRI mutual funds drops sharply if you stay invested longer.

So instead of frequent switching, patience pays.

TDS on Mutual Funds for NRIs – The Big Shock

Now comes the most misunderstood part.

TDS Rates for NRIs

| Fund Type | TDS |

|---|---|

| Equity LTCG | 10% |

| Equity STCG | 15% |

| Debt Funds | 20%–30% |

Even if your actual tax liability is lower, AMC deducts TDS first.

This is why many NRIs panic when redemption happens.

But relax.

You can claim a refund by filing ITR.

Real-Life Example of NRI Mutual Fund Tax

Let’s make this real.

Example 1: Equity Fund

- Investment: ₹5,00,000

- Value after 2 years: ₹6,50,000

- Gain: ₹1,50,000

Taxable LTCG = ₹50,000

Tax = ₹5,000

But TDS deducted = ₹15,000

👉 You can claim ₹10,000 refund.

This is typical capital gains tax for NRI mutual funds behavior.

DTAA Benefits for NRIs

If you live in UAE, US, UK, or Canada, DTAA can help.

DTAA reduces NRI mutual fund tax if:

- You submit Tax Residency Certificate

- You file Form 10F

Many NRIs don’t do this.

As a result, they overpay tax.

Tax on SIP vs Lumpsum for NRIs

Important point.

There is NO separate tax rule for SIPs.

Each SIP instalment is treated as a new investment.

So:

- Capital gains tax for NRI mutual funds applies per installment

- Holding period counts separately

This is where tracking matters.

Repatriation and Tax Compliance

After tax and TDS:

- NRE investments → fully repatriable

- NRO investments → limits apply

Tax compliance is mandatory before repatriation.

Common NRI Mutual Fund Tax Mistakes

Even experienced NRIs make tax mistakes. Unfortunately, most of these mistakes increase NRI mutual fund taxunnecessarily.

For instance, many NRIs ignore TDS refunds. As a result, they end up paying more tax than they are required to. Similarly, frequent switching between funds triggers repeated capital gains tax for NRI mutual funds.

Moreover, some investors unknowingly choose debt funds, assuming they’re safer. However, debt funds often attract higher tax for NRIs. Because of this misunderstanding, post-tax returns suffer.

Therefore, avoiding basic mistakes can significantly reduce NRI mutual fund tax. More importantly, it improves long-term wealth creation

Smart Tax-Saving Tips for NRIs

Here’s what actually works:

- Prefer equity funds for long-term goals

- Hold investments beyond 12 months

- File ITR even if TDS deducted

- Use DTAA benefits

- Avoid frequent switching

Simple habits. Big impact.

FAQs – Capital Gains Tax for NRI Mutual Funds

Is NRI mutual fund tax higher than that for residents?

Rates are the same. TDS makes it look higher.

Can NRIs avoid capital gains tax?

No. But you can reduce it legally.

Is SIP tax-free for NRIs?

No. Capital gains tax applies.

Can I claim a refund on TDS?

Yes. File ITR.

Final Thoughts – Stay Tax Smart, Not Tax Scared

Here’s the truth.

NRI mutual fund tax isn’t unfair. It’s just misunderstood.

Once you understand capital gains tax for NRI mutual funds, investing becomes stress-free.

Remember:

👉 Tax shouldn’t stop you from wealth creation

👉 Planning beats panic

👉 Knowledge saves money

If you invest smart and stay compliant, Indian mutual funds can still be one of the best wealth-building tools for NRIs.

Disclaimer: Mutual fund investments are subject to market risks. Tax laws may change. Consult a qualified tax advisor before investing.

Pingback: NRI SIP Investment in India: Can NRIs Invest in SIP?

Pingback: NRI Stock Market Glossary: A–Z Terms Explained