Zerodha vs Fyers for NRI explained in detail. Compare charges, PIS support, apps & features to choose the best trading app for NRIs.

Table of Contents

- Why NRIs Must Choose Brokers Carefully

- Zerodha vs Fyers for NRI – Quick Overview

- Understanding NRI Trading Rules (Before Choosing a Broker)

- Zerodha for NRI – Pros, Cons & Real Costs

- Fyers for NRI – Pros, Cons & Real Costs

- Zerodha vs Fyers for NRI: Charges Comparison

- Zerodha vs Fyers for NRI: Trading Platforms & Apps

- PIS vs Non-PIS Support – Who Does It Better?

- Account Opening Experience for NRIs Abroad

- Which Is the Best Trading App for NRIs in 2026?

- Real-World NRI Use Cases

- Common Mistakes NRIs Make While Choosing a Broker

- FAQs – Zerodha vs Fyers for NRI

- Final Verdict – Zerodha or Fyers?

1. Why NRIs Must Choose Brokers Carefully

If you’re an NRI, investing in India isn’t as simple as downloading an app and clicking “Buy.” Between RBI rules, PIS reporting, bank tie-ups, and higher brokerage, choosing the wrong broker can cost you time, money, and peace of mind.

That’s why the debate around Zerodha vs Fyers for NRI investors is so important. Both are popular among resident Indians—but do they really work well for NRIs?

And more importantly, which is the best trading app for NRIs in 2026?

Let’s break it down honestly—no marketing fluff, no bias.

2. Zerodha vs Fyers for NRI – Quick Overview

| Feature | Zerodha | Fyers |

|---|---|---|

| NRI Support | Yes (Limited) | Yes (Growing) |

| PIS Account | Supported | Supported |

| Non-PIS | Limited | Better |

| Brokerage | Higher for NRIs | Slightly lower |

| Trading App | Kite | Fyers One / Web |

| Ease of Account Opening | Slow | Faster |

| Best Trading App for NRIs? | Good | Very Competitive |

Right away, you’ll notice this isn’t a one-sided battle. Zerodha vs Fyers for NRI depends heavily on how you trade.

3. Understanding NRI Trading Rules (Before Choosing a Broker)

Before we even talk about Zerodha vs Fyers for NRI, let’s align on rules:

NRIs must:

- Trade equities via PIS accounts

- Link Demat + Trading + Bank

- Report trades to RBI

- Use NRE or NRO accounts

This means not all trading apps marketed in India are the best trading app for NRIs.

That’s where broker capability really matters.

4. Zerodha for NRI – Pros, Cons & Reality Check

Zerodha is India’s largest discount broker. But is it ideal for NRIs?

✅ Pros of Zerodha for NRIs

- Trusted brand

- Stable Kite platform

- Transparent pricing

- Good educational content

❌ Cons of Zerodha for NRIs

- Higher brokerage than residents

- Limited Non-PIS flexibility

- Slow account opening

- Bank-specific PIS tie-ups only

Many NRIs assume Zerodha automatically means “best.” But in the Zerodha vs Fyers for NRI debate, Zerodha isn’t always the cheapest or fastest.

5. Fyers for NRI – A Quiet but Strong Competitor

Fyers doesn’t advertise aggressively—but among NRIs, it’s quietly becoming popular.

✅ Pros of Fyers for NRIs

- Better Non-PIS flexibility

- Competitive pricing

- Modern trading interface

- Faster onboarding for NRIs abroad

❌ Cons of Fyers

- Smaller support team

- Less brand recall than Zerodha

- Fewer educational resources

Still, when comparing Zerodha vs Fyers for NRI, Fyers often wins on practical usability.

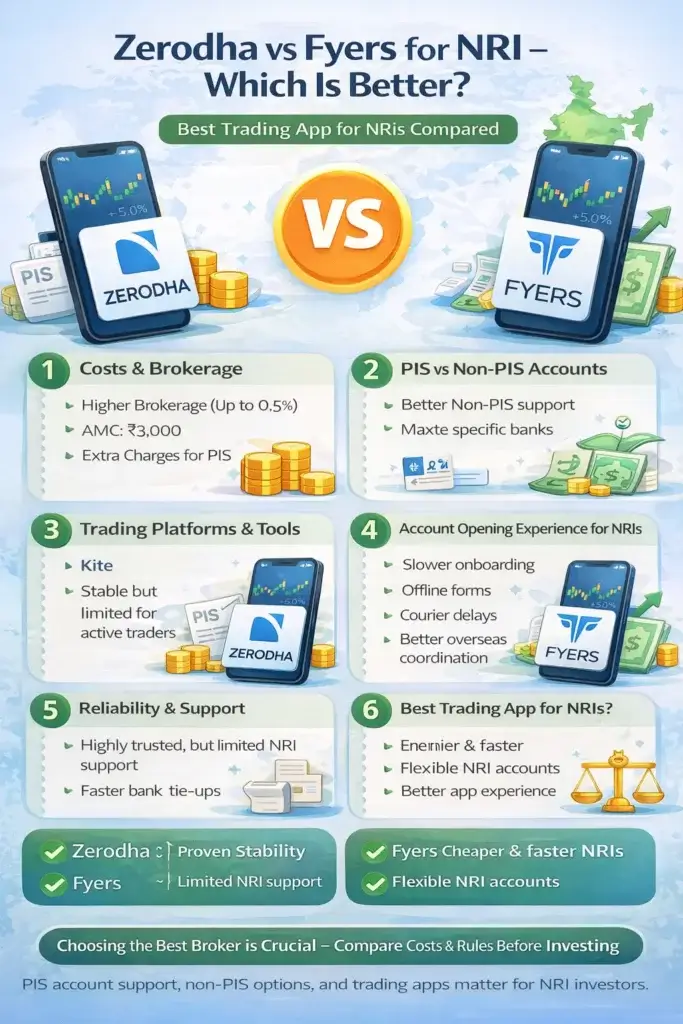

6. Zerodha vs Fyers for NRI: Brokerage Comparison

Here’s where things get real.

| Charges | Zerodha | Fyers |

|---|---|---|

| Equity Delivery | ~0.5% | ~0.3% |

| Intraday | 0.03% | 0.03% |

| AMC | ₹3000+ | ₹2000–₹2500 |

| PIS Charges | Extra | Lower |

For active traders, Fyers often becomes the best trading app for NRIs purely on cost efficiency.

7. Zerodha vs Fyers for NRI: Trading Apps Compared

Zerodha Kite

- Clean UI

- Stable

- Less customizable

Fyers Platform

- Advanced charts

- Faster execution feel

- More trader-friendly tools

If you trade actively, the Zerodha vs Fyers for NRI app experience often tilts toward Fyers.

8. PIS vs Non-PIS – Who Handles It Better?

Both brokers support PIS.

However:

- Zerodha → Strict bank tie-ups

- Fyers → Slightly flexible reporting support

For NRIs wanting smoother operations, Fyers feels closer to the best trading app for NRIs here.

9. Account Opening from Abroad – Real Experience

Let’s be honest—this matters.

Zerodha

- Physical forms

- Courier delays

- Longer timelines

Fyers

- Faster processing

- Better overseas coordination

In the Zerodha vs Fyers for NRI comparison, onboarding speed is a clear Fyers win.

10. Which Is the Best Trading App for NRIs in 2026?

Here’s the truth:

- Long-term investors → Zerodha works

- Active traders → Fyers wins

- Cost-sensitive NRIs → Fyers

- Brand-focused NRIs → Zerodha

So the best trading app for NRIs depends on you.

11. Real-World NRI Examples

Case 1: Dubai-based IT Professional

Trades monthly → Chooses Zerodha for stability

Case 2: Kuwait-based Trader

Trades weekly → Chooses Fyers to reduce brokerage

This is why Zerodha vs Fyers for NRI isn’t one-size-fits-all.

12. Common Mistakes NRIs Make

- Choosing brokers meant for residents

- Ignoring PIS charges

- Underestimating compliance delays

- Assuming “popular = best”

Avoid these, and choosing the best trading app for NRIs becomes easier.

13. FAQs – Zerodha vs Fyers for NRI

Is Zerodha allowed for NRIs?

Yes, but with PIS limitations.

Is Fyers better for NRIs?

In many cases, yes—especially for active traders.

Which is cheaper?

Fyers, in most scenarios.

Which is safer?

Both are SEBI-regulated.

14. Final Verdict – Zerodha or Fyers?

After comparing everything—charges, apps, onboarding, and real NRI pain points—the verdict is clear:

- Zerodha vs Fyers for NRI isn’t about popularity

- It’s about fit

👉 If you want brand trust and simplicity, go Zerodha

👉 If you want lower cost and flexibility, Fyers may be the best trading app for NRIs in 2026